Would you throw good money after bad? Well, if you are keeping your money in the bank and still paying taxes after reading this, you are throwing away everything you have worked for.

The undeniable and catastrophic truth behind the absolute collapse of the American economy is discussed int his article. America is getting hit with two major economic tsunamis and only a scant few are paying attention.

Catastrophic Statistical Comparisons

Most financial experts agree that there is an 800 pound gorilla in the room that is totally being ignored by the main stream media. The 800 pound gorilla is the college Student Load Program.

A striking parallel can be made between the Student loan debt of 2016 and the housing market bubble of 2007. For purposes of comparison, please keep in mind that the housing bubble collapsed the economy of the United States. The only reason that the collapse did not turn into a free-fall was because Congress allowed Wall Street to financially rape the people’s money and forcibly borrowed against the people’s future earnings. We called this process “bail-outs”. The problem is that the bail-outs were not able to stem the tide of the debt, it only served to slow down the crash and burn, while the bankers figured out how to liberate our personal assets as well (e.g. bank accounts and retirement funds).

The Twin Towers of Doom

I would be willing to bet that most of you think that the above-mentioned subtitle reference was about 9/11. It’s not, it is about the coincidence of a massive debt bubble that will ultimately make the housing market bubble look tame. And please remember that the housing market bubble is still critical and the first wave of this bubble nearly killed America.

America is ready to get hit with a new financial tsunami and it is the college Student Loan Debt. Before exploring the train wreck awaiting the American people because of the student loan debt problem, let’s dust off some cobwebs and show the readers the housing market bubble that nearly drove a stake through our collective hearts.

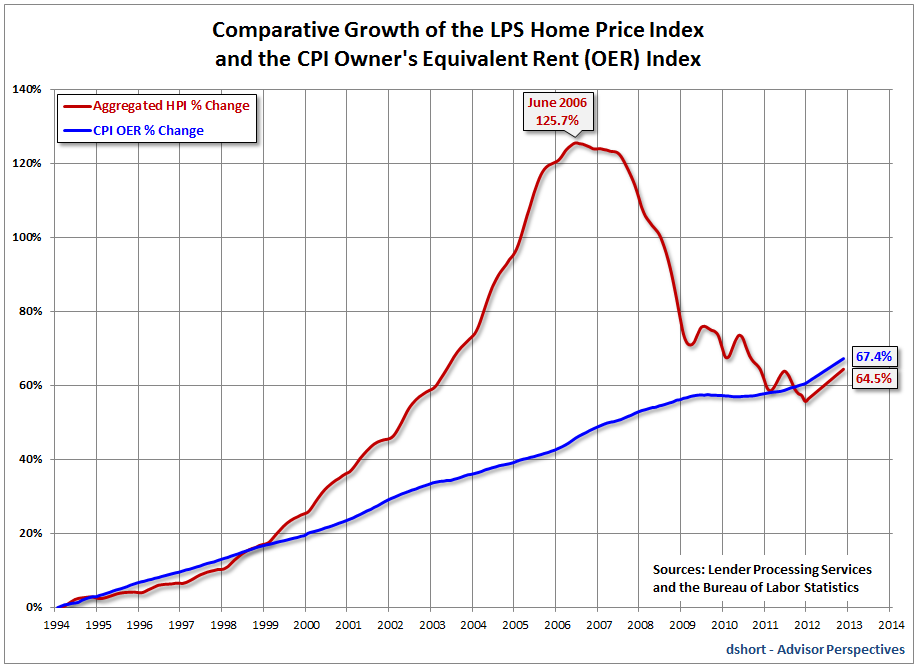

Don’t worry about the zeros, you will get eye strain. The important thing to see here is the astronomical rate of debt increase. The housing market bubble and the college Student Loan debt are nearly identical in their rate of ascension.

Pay particular attention to the collapse of the housing market. I laugh at the morons at MSNBC, Fox, CNN and all the other corporate controlled media outlets that repeatedly tell us our housing market is recovering. Recovering? Draw a straight line through the middle of he graph lines and even Ray Charles could see that the housing market is still crashing. What about those tiny spikes in the charts? They are called the “dead man’s bounce”, named after what happens when a body plunges to the street from the top of a tall building. What housing recovery? Mix in a little MERS mortgage fraud designed to steal home mortgages by creating a series of fake mortgage notes so the borrower does not know who to pay their mortgage to until it is too late, then we have the continuation of a crisis, that by itself could bring down the economy.

Meet the New Housing Bubble

A picture is worth a thousand words.

Anyone that cannot see the striking similarities between the housing market bubble and the student loan bubble, needs their eyes examined!

The Largest Asset of the U.S. Government is the Student Loan Debt

Tyler Durden made an interesting discovery as he found that a full 97% of principal for the Student Loan debacle is guaranteed by the US government. With nearly one in three college loans in repayment delinquency by over 30 days, we would be wise to look up in order to see what is coming. Do you see that 2,000 foot financial wall of water approaching America? The American economy is in such bad shape that the federal government’s biggest asset, student loan debt, is also its biggest liability.

Silence for effect ( IS IT SINKING IN, YET?) ………..

When the student loan debt begins to cut the legs out of the federal government’s financial resources, how will the government maintain financial support for the FDIC (insuring bank accounts), and home loans (the VA and FHA)?

How could anyone not notice what was happening? Sit down before you faint, the following chart will make you ask why you are still paying taxes to this failed entity we call the The United States of America.

With regard to the above chart, there is no mental assembly required. The numbers speak for themselves. Normally, when a country speaks about its assets, it talks about manufacturing or the discovery of the new mineral resources. In the United States, our biggest financial asset is our biggest financial debt. If this represented your personal financial strategy, how long would your family survive?

ECONOMIC TSUNAMI #1-THE CONTINUING HOUSING BUBBLE

ECONOMIC TSUNAMI #2- THE COLLEGE STUDENT LOAN DEBT

Conclusion

In descending order, American is facing several more tsunamis of economic destruction which will spin off of these two gigantic financial melt-downs and they are the banks, the Stock Market, manufacturing, shipping, and by the time we reach this point, you will not be able to obtain food and medicine.

REMEMBER: STORE FOOD, WATER, GUNS, NATURAL HEALTH CARE FOR CHRONIC CONDITIONS, AMMO, GOLD, AND THE BIBLE.

Credit to Common Sense

No comments:

Post a Comment