Thursday, April 5, 2012

Japan Mobilizes Troops To Intercept N. Korean Rocket

(RTTNews) - Japan will send 450 Self-Defense Force (SDF) personnel to Ishigaki island in Okinawa prefecture to intercept a North Korean rocket if it poses a danger to Japan, the Defense Ministry said on Monday.

Under the plan, 200 SDF troops will go to Miyako island in connection with the deployment of ground-based Patriot Advanced Capability-3 interceptors, mainly in Okinawa, the Kyodo news agency reported quoting Ministry officials. Even though possibility of the rocket or its debris falling on Japanese territory is minimal, the government is taking all precautionary measures.

Defense Minister Naoki Tanaka last week ordered the SDF to intercept the rocket should any part of it falls into Japanese territory. He issued the order after North Korea announced last month its plan to launch a satellite, which the United States, South Korea and several other countries believe to be a cover for testing a long-range ballistic missile sometime between April 12 and 16.

On Ishigaki, SDF forces are planning to camp out on reclaimed land near Ishigaki port as the SDF has no facilities there. About 140 vehicles are also to be deployed. The Ministry will also deploy 100 personnel at both the Air Self-Defense Force's Naha base and the Chinen submarine base in Nanjo on Okinawa island, the report said.

South Korea has also mobilized its defense forces to shoot down the Communist neighbor's rocket if it strayed from its trajectory and violated the South's air space.

RTT News

Rothschild to merge British and French assets

(Reuters) - The Rothschild banking dynasty is to fully merge its operations in France and Britain under one holding company, the Financial Times reported on Thursday.

The newspaper said the family aims to boost regulatory capital at a time when the investment-banking industry is fighting to adapt to tougher regulation and economic slowdown in Europe. David de Rothschild, who will become chairman of the merged group, is quoted by the FT as saying the restructuring would "allow the group to become more competitive against rivals while ensuring the family's control over the group in the long-term."

Regulatory capital will be "significantly enhanced" to prepare for tougher requirements under the Basel III regime, the FT said.

Russia warns the West not to arm Syria's rebel fighters

Russia yesterday claimed the West was undermining the work of international peace envoy Kofi Annan, warning Britain and her allies not to arm Syria's rebels as a deadline for implementing an international peace plan approaches.

Moscow's Foreign Minister claimed that even if Western nations decided to "arm the Syrian opposition to the teeth", rebel fighters would be powerless to vanquish the better armed and still largely loyal national army. "The carnage will go on for many years," warned Sergey Lavrov.

His comments came as yet more civilians were killed by shellfire and gun battles across the country, with President Bashar al-Assad refusing so far to abide by the terms of Mr Annan's peace initiative and withdraw his tanks and troops from besieged towns, despite promising to accede to the terms of a ceasefire proposed by the former UN Secretary General.

Heavy machine gun fire was heard across the old city of Homs yesterday, while according to the British-based Syrian Observatory for Human Rights, a man, 50, and his younger brother were killed in the north west Idlib province when soldiers opened fire on their car from a tank.

Russia's criticism followed an announcement this week from "Friends of Syria" group of Western and Arab nations that they would be creating a fund for the Syrian opposition.

n A former goalkeeper for the Syrian national team has said that athletes from his country do not want to compete in this year's London Olympics because they "don't want to play for a flag they have no pride or faith in". In an interview with ITV News, Abdelbasset Saroot, 20, spoke out against the ongoing violence in Syria, and said that many competitors are taking part only because they fear repercussions if they refuse.

The Independent

We Owe How Much??

One of the problems with the debate over the “national debt” is that there’s no generally agreed upon definition of that term. Is it what the federal government owes, or what it owes foreigners, or what the whole country, private and public sector together, owes? Does it include off-balance-sheet items and contingent liabilities?

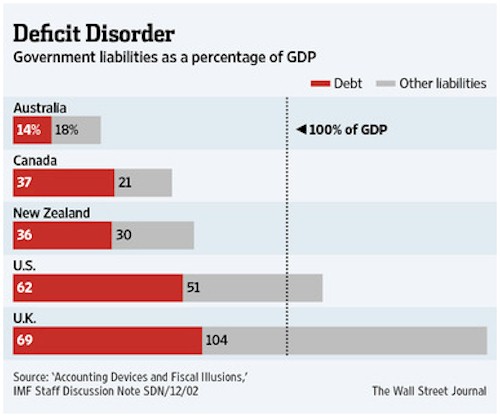

There’s a hundred-trillion dollar gap between lowest and highest on this spectrum, which allows each commentator to confuse the rest of us by picking the measure that best suits their point of view. New York Times columnist Paul Krugman, for instance, uses “net debt” — the amount that the US owes foreigners — to argue that since this number is relatively small and slow-growing, we’re actually fine. Analysts using broader definitions of debt come to the opposite, more apocalyptic conclusion. Consider this from today’s Wall Street Journal, on the impact of off-balance-sheet obligations:

Smoke, Mirrors and Public Deficits

By RICHARD BARLEY

Are public debt and deficit numbers illusory? Perhaps, judging by the ruses employed by governments and identified by the International Monetary Fund’s Timothy Irwin in a recent staff note. Deficit crises in developed countries may only increase the allure of such devices, although they may do little to help in the long run.

European countries got creative as they strove to hit targets to join the single currency during the 1990s. In 2005, Organization for Economic Cooperation and Development researchers cataloged 192 cases of one-time measures and accounting maneuvers across Europe—50 in Greece alone—with effects ranging from negligible to 2% of GDP. In 1997, for instance, France took on the pension liabilities of France Télécom in exchange for a payment of €5.7 billion ($7.6 billion), or 0.5% of GDP.

But Europe wasn’t alone in playing games. In 2003, the U.S. proposed buying 100 refueling planes via operating leases, which would have kept the cost from being recognized upfront. The Congressional Budget Office said that was federal borrowing in disguise and would prove more expensive than a normal purchase.

The euro-zone debt crisis has put these techniques front and center. Portugal hit its 2011 target only via a transfer of bank pension assets that shaved 3.5 percentage points off its deficit.

Likewise, the U.K. is taking on the Royal Mail’s pension plan to pave the way for privatization. The plan brings with it £28 billion ($44.8 billion) of assets, thereby reducing the country’s 2012-13 deficit. But the U.K. is also taking on long-term liabilities on behalf of the company with a present value of £37.5 billion—which aren’t recognized immediately. So accounting transforms the Royal Mail’s pension deficit into a short-term gain for the U.K. budget but at a long-term cost.

Keeping long-term liabilities out of the picture is a common tactic: In the U.S., debt was 62% of GDP in 2010, but including civil-service pension and other liabilities raises the total to 113%, Mr. Irwin notes. Public-private plans for infrastructure have also shifted upfront investment costs off-budget but have raised long-term debt risks—often through government guarantees.

The crisis has narrowed governments’ options. One way to flatter the statistics is via optimistic growth assumptions, although skeptical markets and the rise of independent fiscal watchdogs such as the U.K. Office for Budget Responsibility make this difficult. Another way is to shift cash flows forward, as Germany, Greece, Portugal and Belgium did in the past via securitizations of future government revenue. This, too, may now prove a tricky sell.

Investors trying to keep track of governments should remember Goodhart’s law: As soon as an indicator becomes a target for conducting policy, it loses its informational value. It also becomes a target for manipulation. That is a sobering thought given the euro zone’s obsession with deficit targets. They might just conceal problems building up elsewhere.

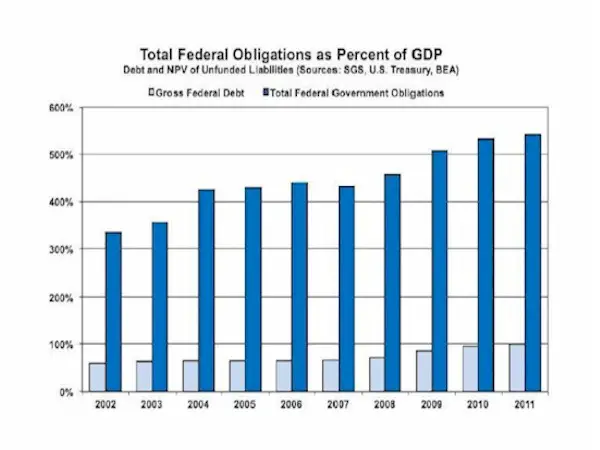

Then there are the “unfunded liabilities” of entitlements like Social Security and Medicare, which dwarf the official national debt. From a recent Zero Hedge article:

Massive $17 Trillion Hole Found In Obamacare

Two years ago, when introducing then promptly enacting Obamacare, the president stated that healthcare law reform would not cost a penny over $1 trillion ($900 billion to be precise), and that it would not add ‘one dime’ to the debt. It appears that this estimate may have been slightly optimistic… by a factor of 1700%. Because coincident with the recent Supreme Court debacle, in which a constitutional law president may be about to find that his magnum opus law is, in fact, unconstitutional, someone actually read the whole thing cover to cover, instead of merely relying on the CBO’s, pardon Morgan Stanley and Goldman Sachs’, funding estimates. That someone is Republican Jeff Sessions who after actually running the numbers has uncovered that the true long-term funding gap is a mind-boggling $17 trillion, just a tad more than the original sub $1 trillion forecast.

This latest revelation means that total underfunded US welfare liabilities: Medicare, Medicaid and social security now amount to $99 trillion! Add to this total US debt which in 2 months will be $16 trillion, and one can see why Japan, which is about to breach 1 quadrillion in total debt (yen, but who’s counting), may want to start looking in the rearview mirror for up and comer competitors. And while Obama may have been taking creative license with a number that is greater than total US GDP, he was most certainly correct when saying that Obamacare would not add a penny to US debt. Because the second the US government comes to market to fund a true total debt/GDP ratio of 750%, it is game over, and the Fed will have its hands full selling Treasury puts every waking nanosecond to have any time left for the daily 3pm stock market ramp.

Here’s a chart (compiled by John Williams’ Shadowstats) illustrating the impact of adding unfunded liabilities to the national debt:

There are two reasons that debt and unfunded liabilities are treated as separate things:

1) The practice allows government to hide its true obligations in the same way that Enron did — right up to the day it evaporated. In other words, it’s a legally sanctioned lie.

2) Debt and unfunded liabilities are, at first glance, different in some ways. Debt is a legal obligation that gives the lender recourse, i.e. some way of getting back some of their money. In the private sector a lender who’s not getting paid can seize the borrower’s assets or force the latter into bankruptcy court where a judge decides who gets what. With sovereign debt, the creditor (who lent money by buying bonds) can sell those bonds and use the proceeds to buy up the borrower’s assets.

Unfunded liabilities, in contrast, are simply promises that don’t carry a legal obligation. In theory, Medicare could be cancelled tomorrow by Congress. Just like that, the program and its associated unfunded liabilities would disappear.

So the question becomes, how real — and therefore how dangerous — are US unfunded liabilities? The answer is that because they represent a promise to tens of millions of retired baby boomers who expect to get free money and health care for the last 30 or so years of life, they’re effectively more real an obligation than a Treasury bond.

A politician who messes with the Most Selfish Generation’s free health care will find himself back in the private sector before the polls close in the next election. Compare this with the probable repercussions of stiffing China or Saudi Arabia on bond interest — some contentious headlines and a bit of turmoil in the foreign exchange markets that most voters would hardly notice — and it’s clear that unfunded liabilities have, if anything, a more solid claim on future economic activity in the US than does interest on Treasury bonds.

So our true national debt is government debt plus private sector debt plus off-balance-sheet obligations plus unfunded liabilities, which comes to somewhere around half a million dollars per man, woman and child, or two million per family of four.

We can’t pay this of course, so the story of the next few years will be the search for the least painful way of breaking our promises. And history is pretty clear on this: a country with a printing press will always use it before exploring the harder options of actual default, whether through non-payment of interest or cancellation of benefits.

Dollar Collapse

Spain debt auction fuels bailout fears

In an auction of medium-term debt on Wednesday, Spain sold €2.6bn in the sale of notes maturing in 2015, 2016 and 2020 - the bottom of its €2.5bn-€3.5bn target.

The 2020 bond on offer was sold at an average yield of 5.34pc, with a bid cover of three times.

Spain also sold three and four-year debt. For the notes maturing in 2016, the average interest rate on the three-year notes was 2.89pc, up from 2.44pc in the last such auction on March 15. The bid to cover ratio was 2.4, half what it was in the last auction. The average interest rate on the 2016 note shot up from 3.37pc to 4.32pc. The bid-to-cover ratio fell from 4.1pc to about 2.5pc.

The yield - the interest rate a country has to pay on its debt and an indication of risk - on Spanish 10-year bonds has been rising in recent weeks and stood at 5.53pc in the secondary market shortly after Wednesday's sale, compared to 4.9pc a month ago.

Borrowing costs had been expected to rise, reflecting growing investor concern over Spain's public finances and worries that Spain will be joining Greece, Portugal and Ireland in seeking a bailout.

The higher the yield, the more expensive it is for a country to raise money on the bond markets. Last November, Spain's yield hit 6.7pc - close to the point where a country can no longer afford to maintain its debt and seek a bailout

Peter Chatwell, interest rate strategist at Credit Agricole in London, said: "The results are a far cry from the blowout auctions we saw between December and February, which will no doubt be interpreted as the LTRO bid having dried up.

"There appears no problem in issuing the paper, but judging by the average yields at these auctions, demand is now much more price sensitive and a truer gauge of investor sentiment."

Wednesday's bond sale came a day after Finance Minister Cristobal Montoro spelled out the details of the new conservative government's 2012 budget proposal, an austere blueprint that aims to get Spain's deficit down from 8.5pc of gross domestic product last year to 5.3 percent this year.

The cuts are being introduced at a time when the country's economy is shrinking and expected to contract 21.7pc on the year.

The government also revealed on Tuesday that Spain's national debt will shoot up this year from 68.5pc of GDP to about 80pc.

The Telegraph

Moscow: Mid East at boiling point

Iranian spokesmen are maneuvering for a postponement of the nuclear negotiations with world powers set to take place April 13-14 in Istanbul,DEBKAfile’s Iranian sources report. It is feared in Washington and Jerusalem that Tehran is working toward two goals: To have the venue removed from Istanbul and to buy a couple more months before the diplomatic crunch, considering that the US and Israel are treating the April talks as the last chance for diplomacy to reverse Iran’s drive for a nuclear weapon. A postponement would therefore delay any military option that Israel or possibly America would choose to exercise.

The Iranians want the site moved to Moscow, Vienna or Geneva, a change opposed by Washington because it would consume several more months before the talks got started. Tehran is also signaling through Moscow that it is not prepared for the diplomatic dialogue to take place under military threat or economic sanctions.

While Israeli Prime Minister Binyamin Netanyahu refrained from mentioning military options in presenting his government’s three-year record Tuesday, April 3 – ignoring the three large-scale military movements afoot by the US, Russia, Turkey, Syria, Greece - and Israel itself, Moscow is talking about an imminent military conflagration as a result of the continuing US and Israeli military buildup in the Persian Gulf.

Russia’s Deputy Foreign Minister Sergey Ryabkov said Tuesday, April 3: “The Middle East standoff could boil over into military action at any moment.” Referring to the massing of military and naval forces in the Persian Gulf, he said: The pot can explode if the diplomatic valve is not opened.”

He made no mention of the scheduled April 13-14 nuclear talks. One of the most influential figures in today’s Tehran Mohsen Rezaie was more explicit: “Given the fact that our friends in Turkey have failed to fulfill some of our agreements, the talks… had better be held in another friendly country.”

He did not specify which agreements Ankara had failed to meet, but his rejection of Istanbul as the venue for the talks was unqualified.

Strong criticism of the Erdogan government also came from a senior member of Iran’s parliamentary foreign policy and national security commission Esmaeel Kosari. He said during a visit to Azerbaijan:”Turkey serves as the United States and Israel’s messenger and mediator. The Turkish government will be hated by its citizens if it continues this role.”

In Iran’s political culture, neither of these men would have spoken without a green light from the office of the all-powerful supreme leader Ayatollah Ali Khamenei.

Kosari’s mission in Baku was to investigate recent reports that Azerbaijan had given Israeli permission for its bases to be used by the Israeli Air Force in an attack on Iran.

Early Wednesday, April 4, Iraqi officials suddenly offered Baghdad as the venue for the forthcoming world power talks with Iran.

The US and Israel are certain to reject this offer because it would give Tehran the important edge of a key diplomatic event taking place on pro-Iranian soil.

Debkafile

3 or 4 N.Korean subs disappear after leaving east coast bases

South Korea is tracking three to four North Korean submarines that disappeared after recently leaving two bases on the east coast, a South Korean military source said Wednesday.

The source said the submarines are presumed to be of the 370-ton class that the South Korean military has been unable to locate since they departed from two submarine bases on the east coast.

Another source said, “North Korea seems to be actively conducting submarine infiltration drills in the wake of warmer weather recently,” adding, “(The South Korean military) is closely watching the situation without ruling out the possibility of a provocation disguised as a drill.”

Seoul is preparing for a potential surprise attack by Pyongyang aimed at South Korean naval vessels or military bases, as the North has threatened to make strong provocations against the South while planning to launch a long-range rocket between April 12 and 16.

Moreover, the South predicts that the North is highly likely to catch the South off guard at a time when the latter`s military has concentrated its surveillance and strike force in areas near the Northern Limit Line, the de factor maritime border between the two Koreas, after the North sank a South Korean naval vessel in 2010.

Choi Yun-hee, the South Korean Navy`s chief of staff, told The Dong-A Ilbo last month that the North is highly likely to turn the South’s attention to the west coast and commit provocations on the east coast or in rear areas.

The North has 80 percent of its 70 to 80 submarines and submersibles ranging from 130 to 1,500 ton-class deployed on the east coast. It has large submarine bases in South Hamgyong Province.

Military authorities of South Korea and the U.S. monitor movement at the submarine bases. Once they depart from the bases and go under water, however, tracking the vessels down is difficult.

Donga

The Second Foreclosure Tsunami Is Coming, And Is About To Kill Any Hopes Of A "Housing Bottom"

In what appears to be surprising news for some, Reuters has an article titled "Americans brace for next foreclosure wave" whose key premise is that "a painful part two of the [housing] slump looks set to unfold: Many more U.S. homeowners face the prospect of losing their homes this year as banks pick up the pace of foreclosures." Thank the robosettlement, where in exchange for a few wrist slaps, contract law was thoroughly trampled by America's attorneys general, but far more importantly to the country's crony capitalist system, the foreclosure pipeline was once again unclogged, and whether one does or does not have a legal title on a given house, the banks are now fully in their right to foreclose on it. What this means also is that America's record shadow housing inventory, which is far greater than any fabricated number the NAR reports on a monthly basis, is about to get unleashed on buyers, shifting the supply curve much further to the right, as up to 9 million new properties slowly but surely appear on the market. And while many will no longer be able to live mortgage free, forcing them to go out and rent (and no longer be able to afford incremental iGizmos), it also means that the prevalent price of homes is about to take another major tumble, making buffoons out of all those who, once again, called for a housing bottom in early 2012. Here's the simply math: there will be no housing bottom until the 9 million excess homes clear. Period. Until then it is a buyer's market, even if said buyer is unable to obtain bank financing, as ultimately it will be the seller who is forced to monetize (or vacate if underwater) their home in a world of ever diminishing cashflows. The fear of the supply onslaught will only make the dumpage that much faster.

As a reminder, this is what America's recover shadow inventory looked like recently:

For those curious how much more foreclosed properties are about to hit the market, we have the answer. Courtesy of RealtyTrac we know how many homes were foreclosed upon in the period until November 2010, when robosigning became a prevalent, if short-lived issue, or roughly 330,000 a month. In the aftermath, this average has dropped to 227,000 a month: a roughly 100,000 difference in less foreclosures each month! Which means that in the deferred amount of foreclosures, over and above the already endogenous deterioration in home prices and declining household income, means that there is at least 1.6 million in homes that are just waiting for a green light to be foreclosed upon, sending shadow inventory in the double digit millions, and unleashing a selling wave unlike any seen before. Behold the deffered foreclosures in all their glory:

Translation: Just like John Paulson lost billions on his massively wrong way bets that housing would soar (ironically, after getting the move lower correct), so Goldman's recent bet that properties will rebound is about to cost the firm dearly.

Because at the end of the day, it is all about supply and demand, or, said otherwise, money.

Reuters explains further:

"We are right back where we were two years ago. I would put money on 2012 being a bigger year for foreclosures than 2010," said Mark Seifert, executive director of Empowering & Strengthening Ohio's People (ESOP), a counseling group with 10 offices in Ohio.

"Last year was an anomaly, and not in a good way," he said.

In 2011, the "robo-signing" scandal, in which foreclosure documents were signed without properly reviewing individual cases, prompted banks to hold back on new foreclosures pending a settlement.

Five major banks eventually struck that settlement with 49 U.S. states in February. Signs are growing the pace of foreclosures is picking up again, something housing experts predict will again weigh on home prices before any sustained recovery can occur.

Mortgage servicing provider Lender Processing Services reported in early March that U.S. foreclosure starts jumped 28 percent in January.

Well, no. LPS which is going through legal troubles of its own, unfortunately, is very much, less than credible. For the only real source on foreclosure data, we go to RealtyTrac, where we find that February foreclosures hit 206,900, the second lowest in many years, and higher only than December 2011's period low 205,000 (see chart above). But while there is no need to fabricate data, foreclosures will eventually come, as banks, first slowly, then very, very fast, start sending out foreclosure notices. What happens next will be entire neighborhoods with "Foreclosure" signs in front of the houses, doing miracles to prevailing home prices.

A January report by the Neighborhood Economic Development Advocacy Project in New York found that in the first half of 2011 the number of 90-day pre-foreclosure notices in New York City outnumbered court foreclosure actions by a ratio of 14 to one, indicating that while proceedings were initiated against many homeowners, they were left incomplete.

"Now the banks have a settlement, foreclosure numbers for 2012 are going to be high," said NEDAP co-director Josh Zinner.

A recent survey by the California Reinvestment Coalition, an umbrella group of nearly 300 non-profit groups in the state, of member agencies found 75 percent of respondents expected increased demand for their foreclosure prevention services in 2012 but more than a third had to scale back services because of funding cuts.

"Funding is a major concern given what our members expect for this year," said associate director Kevin Stein.

Needless to say, the return of reality, i.e., when one actually has to pay for living somewhere, instead of living 5 years without making a mortgage payment like the Ritters, means a return of ever louder calls for socialist debt principal reduction. What is odd is that nobody seems to care: certainly not the millions of other hard working Americans who would end up footing the bill.

All this has non-profits intensifying calls for the Federal Housing Finance Agency to drop its opposition to allowing the government-backed mortgage giants Fannie Mae and Freddie Mac it regulates to reduce principal for underwater homeowners.

Principal reduction involves reducing the amount borrowers owe in order to make a loan modification affordable for struggling homeowners. Republicans and the FHFA oppose principal reduction because of the risk of "moral hazard"- that homeowners who do not need help will seek to abuse largesse and have their mortgages reduced too.

"Until banks engage in meaningful principal reduction as a matter of course," ESOP's Seifert said after a recent protest at a Chase branch in Cleveland, "this crisis will not end."

Well then it won't. Because since every bank asset is another bank's liability, unless the government pulls a GSE, and funds the wholesale mortgage reduction (call it the "final solution" of ubiquitous and unquestioned socialism), banks will not do this. And while this next bank bailout is only years (at most) away, in the meantime we will see banks do just what they always do: foreclose once again, and release the pent up vacant homes into the market. Which for anyone who has taken Econ 101 means prices are about to take yet another dive lower, and the entire housing recovery plan can be scrapped. As to what it means for the Fed's plans for future easing, well... we believe our readers are smart enough to figure this out on their own.

Zero Hedge

Subscribe to:

Comments (Atom)