Is it a coincidence that an earthquake that struck Virginia and rattled dozens of other states occurred amid Pat Robertson's "Sign of the Times" special on the "700 Club?"

"Are we in the last days?" Robertson asked during Wednesday morning's live online streaming of the "700 Club" as he continued his teaching on the "Sign of the Times."

"The earth moved," Robertson said ominously, describing the earthquake that struck Virginia Tuesday, "and then it moved all over this part of the country."

As a magnitude 5.8 earthquake struck Virginia around 1:51 p.m. on Tuesday, many folks wondered about its unusual strength. Aftershocks were felt all along the East Coast, West Coast, in some southern states, and even inCanada.

Don Blakeman, a geophysicist with the National Earthquake Information Center (NEIC), told The Christian Post Wednesday that although Virginia has a fair number of earthquakes like most other states, the temblor's strength was unusual.

"Virginia has a fair number of quakes ... but they are typically small. [Virginia] does have a number of them every year, but it is pretty unusual to have one of this size," Blakeman said.

The NEIC geophysicist added, "We should expect some aftershocks, because when you have a good size quake like this then it’s pretty typical to have some aftershocks. It's possible to have some fairly large ones, but most of them will be [in the 3.0 range]."

Earthquake activity was one of the signs of the end, Robertson said, referring to other occurrences such as food shortages and conflicts between nations, which Christians believe will precede Christ's return.

Robertson explained in Wednesday's program, which focused on natural disasters, that earthquakes are one of the "birth pangs" Jesus Christ refers to in Matthew 24 after his disciples ask about the signs preceding his second coming.

The televangelist, who started his series on signs of the end times on Monday, was not alone in looking to the fulfillment of biblical prophecies amid the quake.

Twitter users took to their accounts yesterday, wondering if the CBN televangelist would speak out on the earthquake.

"Earthquake in DC? Stand by for a Biblical explanation from Pat Robertson," tweeted Armistead Maupin (@ArmisteadMaupin).

Erin Fleming (@ERINonyourRADIO) tweeted, "A hurricane headed for the US, an earthquake this morning in D.C. and rioting in parts of the states as well. Back to you Pat Robertson."

Some Twitter users were skeptical, scoffing at the possibility of God revealing any kind of prophetic word to Robertson.

A handful of comments appeared to make reference to Robertson's controversial remarks during the 2010 earthquake that struck the Caribbean nation of Haiti.

Robertson said, just one day after the rattler devastated the small island, that its people were possibly cursed for allegedly making a deal with the devil during the 1791 slave rebellion against the French.

User warrenstjohn (@warrenstjohn) tweeted, "Eagerly awaiting Pat Robertson's pronouncements on who did what to deserve an earthquake."

Patti (@Floridaline) wrote, "Yippee!!! Tomorrow, Gods Meteorologist, Pat Robertson, will tell us why there was an earthquake near DC!!"

Despite the anticipation, Robertson made it clear Wednesday that he had not received any prophetic word from God regarding the earthquake.

"I can't claim any kind of particular revelation," Robertson said in response to a viewer's question about upcoming natural disasters.

Some viewers of the "700 Club's" "Sign of the Times" program were also skeptical that Tuesday's earthquake was any kind of sign from God about the end of the world.

"We've always had natural disasters, many far worse than the Great Virginia Quake of 2011. So why are the events more of a sign than the events of the past," a viewer watching the live program asked in an accompanying chat room.

Other viewers asked Robertson to comment on the rapture, the possible role of the Roman Catholic Church in end time prophecies, and about the possible identity of the antichrist.

No one appeared to ask when the world can be expected to end, but Robertson had an answer for that anyway.

"It will end when the Gospel is preached to the whole world as a witness," Robertson concluded in Wednesday's program.

The "Sign of the Times" program runs through the rest of the week.

hostgator coupon 2011

This weekend will set the tone for the next month and to a certain extent, the rest of the year. Here is the scenario we are monitoring, this weekend Ben Bernanke will meet in Jackson Hole, Wyoming, with other bankers and global elites to decide the near term and long term fate of the stock market. Yesterday, the Dow Jones rallied 322 points despite economic numbers that came out in the morning that confirmed the U.S. is indeed in the second down leg of a very long depression. U.S. sales of new homes declined for the 3rd straight month, in fact, they are on pace for the worst year on record. According to the Commerce Department, sales fell to a seasonally adjusted annual rate of 298,000, this is 25% lower than 2 years ago during the "official recession" and 70% lower than in the bubble (Keynesian Normalcy) years.

The reason the market rallied on this and other bad news is because Wall Street believes that the FED will soon step in with a major quantitative easing #3 (QE3) announcement, more than likely this weekend. Investors are hoping for deja vu, if you recall it was last year at the Jackson Hole meeting that Bernanke announced QE2. If the FED does not announce QE3 this weekend, this could put the markets into a nose dive as early as this weekend. Not knowing what the FED is going to do or say this weekend makes this a complete gamble for investors going into the weekend, so we expect the FED to set the tone early on Friday.

Remember, 2 weeks ago when the FED put out a statement regarding keeping interest rates near zero for at least the next 2 years, the market acted very bipolar and then rallied 400 points. Only to continue to fall in the days to follow. FutureMoneyTrends.com believes that if the FED doesn't announce QE3, but sends a strong signal that it is willing to step in if needed, this could provide a temporary rally on Friday and possibly Monday, but will eventually fade away as reality starts to get priced in with the markets absent of QE from the FED. To put it simply, any rally on Wall Street that comes without the full announcement of QE3 this weekend is a head fake in our opinion. Without any new QE, FutureMoneyTrends.com does not believe the market has seen its 2011 lows.

Why we believe the FED will NOT announce more QE this weekend

First of all let's be clear, FutureMoneyTrends.com does believe that eventually in the next 3 to 9 months the FED will announce and begin a new round of quantitative easing, something larger than imagination, something that will put Bernanke in the money printing "hall of fame." However, we give an announcement this weekend only a 20% chance, here is why we believe there is an 80% chance Wall Street will be disappointed by the FED.

$1,850 Gold- gold is just too high right now to announce another round of money printing, an announcement of more QE would more than likely push gold over $2,000 and silver over $50 per ounce.

$85 Oil- oil is still too high in our opinion from the last round of QE, oil at $85 is just too close to jumping back over $100 harming global economies and adding even more pressure on food prices.

Price inflation- just last week the government reported that PPI rose 0.2% in July, higher than economist and market expectations. CPI also increased 0.5% in July, with all items increasing 3.6% in the last year.

Politics- the Republican presidential field and some members in both parties in congress are putting a lot of heat on the FED right now. Just last week Rick Perry said for the FED to do more QE would be treason.

Lack of crisis- even with the markets declining in the past month, they have been declining because they are in a post QE world. Let's be real, the economy is just as shitty as it was a month ago or even 6 months ago, the only thing that has changed is QE2 ended in June.

In our opinion, the FED needs the perma-bulls to feel a little more pain, maybe $50 oil and Dow 8,000, or better yet, a late Sunday night Bank of America surprise, perhaps a European bank or full blown sovereign default. "Crisis" is the key word, the FED needs a good crisis, one that will make politicians who are entering into an election year beg the FED to do the dirty work of banker bailouts. The FED itself could actually spark a crisis this weekend by avoiding a strong statement positive to future easing. Without any hints or winks to Wall St. about the future of QE3, we believe a market crash would be imminent.

hostgator coupon 2011

Swallow all liquids in your mouth before reading any further.

Updated numbers for the national debt are just out: It's now $14,639,000,000,000.

When Barack Obama took the oath of office twice on Jan. 20, 2009, CBS' amazing number cruncher Mark Knoller reports, the national debt was $10,626,000,000,000.

That means the debt that our federal government owes a whole lot of somebodies including China has increased $4,247,000,000,000 in just 945 days. That's the fastest increase under any president ever.

Remember the day the Democrat promised to close the embarrassing Guantanamo Bay Detention Facility within one year? That day the national debt increased $4,247,000,000. And each day since that the facility hasn't been closed.

Same for the day in 2009 when Obama flew all the way out to Denver to sign the $787 billion stimulus bill that was going to hold national unemployment beneath 8% instead of the 9.1% we got today anyway? Another $4,247,000,000 that day. And every day since, even Obama golfing and vacation days.

Same sum for the day Obama flew Air Force One nearly four hours roundtrip to Columbus, Ohio for a 10-minute speech about how well the stimulus was working in the politically crucial Buckeye state. Ohio's unemployment rate just jumped to 9% from 8.8% anyway.

Or last week's three-day Midwestern tour in the president's new $1.1 million Death Star bus? National debt went up $16,988,000,000 while he rode around speaking and buying ice cream cones.

Numbers with that many digits are hard to grasp, even for a Harvard head. So, let's put it another way:

One billion seconds ago Bill Clinton was nearing the end of his two terms and George W. Bush's baseball collection was still on the shelves in the Austin governor's office.

The nation's debt increased $4.9 trillion under President Bush too, btw. But it took him 2,648 days to do it. Obama will surpass that sum during this term.

Now, how to portray a trillion, or 1,000 billions. One trillion seconds ago much of North America was still covered by ice sheets hundreds of feet thick. And the land was dotted by only a few dozen Starbuck's.

Obama is saying yes, we can get control of the national debt. But ominously every time he says that he adds that trillions of dollars in infrastructure repairs are badly needed across the country. And with interest rates so low, according to the thinking on Obama's planet, now is an excellent time to borrow even more money.

So, it looks like not too long before Americans learn what comes after 1,000 trillions.

It's quadrillion. But for Bernanke's sake, please don't tell anyone in Washington.

Los Angeles Times

hostgator coupon 2011

UBS’s decision to cut 5 per cent of its workforce brings to more than 40,000 the number of jobs cut by European banks in the past month and to 67,000 this year, as the region’s worsening sovereign debt crisis crimps trading revenue.

UBS, Switzerland’s biggest bank, said yesterday it will eliminate 3500 jobs, mainly from its investment bank. It follows HSBC, which announced 30,000 cuts on August 1, Barclays, which is cutting headcount by 3000, and Royal Bank of Scotland, which is eliminating 2000 posts. Credit Suisse announced 2000 reductions on July 28.

European banks are slashing jobs this year six times faster than their US peers, as concerns about the creditworthiness of Italy, Spain and France roil financial markets and reduce income from fixed-income trading, stock and bond underwriting as well as mergers and acquisitions.

Advertisement: Story continues below

Financial firms are also cutting costs as regulators force banks to hold more and better quality capital to withstand future shocks.

“It’s a bloodbath, and I expect things to get worse before they get better,” said Jonathan Evans, chairman of executive-search firm Sammons Associates in London. “I cannot see a lot of those who have lost their jobs getting re-employed. Regardless of how good someone is, no one wants to talk about hiring. Life will be very difficult for two or three years.”

The 46-member Bloomberg Europe Banks and Financial Services Index has fallen 31 per cent this year. RBS tumbled 49 per cent, Barclays 44 per cent and France’s Societe Generale 48 per cent.

Credit Suisse and UBS both reported a 71 per cent drop in investment-banking earnings in the second quarter. Revenue at Edinburgh-based RBS’s securities unit dropped 35 per cent in the period, while London-based Barclays Capital posted a 27 per cent decline in pretax profit.

“Some job cuts will be done by all banks” with investment banking units, said Stefano Girola, a fund manager at Albertini Syz & Co. in Milan. “Business volumes are poor, especially in equity and corporate bonds divisions.”

European banks are cutting jobs at the fastest rate since the collapse of Lehman Brothers in 2008, eliminating about 67,000 roles so far this year. UK banks account for about 50,000 of those reductions. US lenders announced about 10,500 cuts in the same period.

A lot of the cuts are likely to be permanent, according to Stephane Rambosson, managing partner at executive search firm Veni Partners in London.

“Returns will continue to fall and costs on revenue have just exploded,” Mr Rambosson said. “Somehow banks have to make the equation work. In the long term, there will be far fewer bankers than there were.”

Banks will be forced to continue to cut costs as they struggle to increase revenue amid tougher regulation, according to a report by KPMG.

The Basel Committee on Banking Supervision will require lenders to more than triple the core reserves they must hold to protect themselves from insolvency by 2019. Under Basel III, banks will be obliged to hold core Tier 1 capital equivalent to 7 per cent of their risk-weighted assets, compared with 2 per cent under the previous international rules.

“We’re looking at a fundamental restructuring of banking,” said David Sayer, global head of retail banking at KPMG in London. “Banks have to hold far more capital and more of it in liquidity, which doesn’t generate a return. This means the cost of doing business is higher, leading banks to think about where they’ll make money and pulling out of countries and areas where they won’t.”

UniCredit this week lowered its growth forecasts for the 17-nation euro region for this year and next. The euro area will expand 1.7 per cent this year and 1 per cent in 2012, Unicredit chief euro zone economist Marco Valli said in a note yesterday. That compares with a previous prediction of 2.1 per cent growth in 2011 and 1.7 percent in 2012.

“The banking industry overall is clearly re-shaping its cost base,” said Andrew Gray, banking leader at accounting firm PricewaterhouseCoopers in London. “We may well see some further losses of jobs over the course of the second half of 2011. Exactly where is impossible to say, but we will see some further cuts from other institutions.”

Read more: http://www.smh.com.au/business/world-business/european-bank-job-bloodbath-hits-67000-20110824-1j93f.html#ixzz1W03MmNTp

hostgator coupon 2011

U.S. investors put $1.48 billion into stock mutual funds in the week ended Aug. 17, the first deposits in four months, according to theInvestment Company Institute.

Customers pulled $3.1 billion from U.S. mutual funds that buy bonds, the fourth straight week of withdrawals from fixed income, the Washington-based trade group said today in an e- mailed statement. U.S. stock funds collected $1.13 billion during the week ended Aug. 17.

The equity-fund deposits reversed a streak of withdrawals that accelerated to $30 billion during the previous week, the most since October 2008, ICI data show. Stocks fell in late July and the first three weeks of August amid concerns that the economic recovery is faltering and an unprecedented downgrade of U.S. credit by Standard & Poor’s.

The last previous equity deposits came in the week ended April 20, when $3.05 billion was invested, including $1.92 billion in domestic funds.

The S&P 500 Index, a benchmark for large-company stocks, has lost 14 percent since reaching this year’s high on April 29. The index has advanced 4.8 percent this week, trimming this year’s decline, as traders speculate that policy makers will take further steps to stimulate the economy.

Domestic equity funds experienced $9 billion in redemptions in the first six months of 2011 and may be headed for a record fifth straight year of withdrawals, ICI data show. All stock funds, including those that invest outside the U.S., gathered a net $13.7 billion in deposits in the first half.

Bloomberg

hostgator coupon 2011

CHINA's military is increasingly focused on naval power and has invested in high-tech weaponry that will extend its reach in the Pacific and beyond, the Pentagon says.

CHINA's military is increasingly focused on naval power and has invested in high-tech weaponry that will extend its reach in the Pacific and beyond, the Pentagon says.

China has ramped up efforts to produce anti-ship missiles that could knock out aircraft carriers, improved targeting radar, expanded its fleet of nuclear-powered submarines and warships and made advances in satellite technology and cyber warfare, the Pentagon wrote in an annual report to Congress.

The weapons buildup comes as the Asian economic giant places a growing priority on securing strategic shipping lanes and mineral-rich areas in the South China Sea.

"The evolution of China's economic and geostrategic interests has fundamentally altered Beijing's view of maritime power," the report said.

While Chinese leaders continue to prepare for a potential conflict with Taiwan, they now see a broader role for the People's Liberation Army, with the navy as a crucial element, it said.

"China's leaders have offered unambiguous guidance that the PLA Navy will play a growing role in protecting China's far-flung interests," the report said.

US commanders worry that China's advances could jeopardize America's longstanding military dominance in the Pacific while US officials have accused Beijing of aggressive tactics against neighboring countries over territorial disputes in the South China Sea.

An expanded Chinese naval presence in the region, including warships, submarines, missiles and possible aircraft carriers, would have "implications for regional rivalries and power dynamics," Michael Schiffer, deputy assistant secretary of secretary of defense, told reporters.

Chinese leaders have insisted its modernization program is aimed solely at "self-defense" and accused US officials of trying to portray the armed forces as a threat.

The report said China had sought to strengthen its nuclear forces by adding more "road-mobile" ballistic missiles and by stressing "camouflage" tactics to ensure the atomic arsenal could better survive a potential attack, the report said.

The Chinese buildup includes a new aircraft carrier that recently held its first sea trial. But the Pentagon played down the carrier's importance, saying the ship was a first step towards a future fleet of carriers expected to be built over 10 years.

The new carrier, a Ukrainian ship modified by the Chinese, "will serve initially as a training and evaluation platform, and eventually offer a limited operational capability," it said.

The aircraft carrier still has no warplanes on board and "it will take a number of additional years for an air group to achieve the sort of minimal level of combat capability," Schiffer said.

With an array of new weapons coming on line, China's military will face a challenge in the coming decade as it tries to train troops in new tactics and revise its approach to "adopt modern operational concepts," he said.

The report also noted an internal debate in China about the role of the military and whether the PLA "should develop to advance China's interests beyond traditional requirements."

The report renewed US warnings that China was extending its military edge over Taiwan, citing better artillery that could strike targets within or even across the Taiwan Strait.

China considers Taiwan, where the mainland's defeated nationalists fled in 1949, to be a province awaiting reunification, by force if necessary.

The dispute over Taiwan, including US arms sales to Taipei, has remained a stumbling block to Washington's attempts at promoting a security dialogue with the Chinese military.

Taiwan, and some US lawmakers, have called for the sale of F-16 fighter jets to help counter the Chinese threat.

The Pentagon report covered 2010 and was delayed for five months, following a high-profile visit to Beijing by the US military's top officer in July.

The document estimated China's overall military-related spending was more than $160 billion in 2010, and that its military budget grew at an average of 12.1 per cent over the past decade - outpacing the country's economic growth at 10.2 per cent over the same period.

Chinese military spending, however, is still far below the US defense budget, the world's largest, which was nearly $700 billion in 2010.

The Australian

hostgator coupon 2011

The bank he ran - Lehman Brothers - had collapsed with $639bn of assets two years earlier, triggering financial mayhem.

This week, hedge funds, investors and internet bloggers started to suspect that Brian Moynihan - Bank of America Merrill Lynch's benighted chief executive - was cut from the same cloth. Moynihan has presided over a near 50pc crash in Bank of America's share price since the start of the year that has wiped $70bn from the bank's value. On Tuesday, the cost to protect its debt from default touched new highs, with credit default swaps surging to 435 basis points (bps). That meant that it would cost $435,000 per year to insure $10m in bonds for five years.

In a month of crazy stock market jitters, investors worried about the size of the bank's mortgage-related liabilities and whether the flailing economy would mean the bank's capital adequacy would pass muster. Moynihan, traders claimed, could not be trusted.

The interest rate payable on the cash bonds that Bank of America issued shot up from 3.75pc to 5.5pc - making it 175bps more expensive for it to do business than its nearest rival Citigroup - putting huge pressure on its profit margins. Former analyst Henry Blodget said the bank risked a capital shortfall of between $100bn to $200bn. Investment bank Jefferies predicted a $50bn rights issue.

Specifically, analysts started to project bigger write-offs for the two mortgage issues. First, the so-called "mortgage put back liability" – claims by institutions like BlackRock about potential fraud in original mortgage agreements that were sold on by the banks. Bank of America put aside $8.5bn for this settlement hoping to draw a line under the exposure. But, with a judge not signing off on this until October, the market worried more might be needed.

hostgator coupon 2011

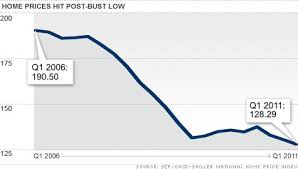

Home prices in the U.S. fell 5.9 percent in the second quarter from a year earlier, the biggest decline since 2009, as foreclosures added to the inventory of properties for sale.

Prices dropped 0.6 percent from the prior three months, the Federal Housing Finance Agency said today in a report from Washington. In June, prices retreated 4.3 percent from a year earlier, while increasing 0.9 percent from the previous month.

Foreclosures are boosting the supply of properties on the market and undercutting the confidence of homebuyers, sapping demand even as mortgage rates tumble to the lowest in more than half a century. The U.S. inventory of homes for sale averaged 3.7 million during the second quarter, the highest since the third quarter of 2010, data from the National Association of Realtors show. The mortgages on 6.5 million U.S. homes had late payments or were in foreclosure in June, according to Lender Processing Services Inc. in Jacksonville, Florida.

“Foreclosures water down home prices because banks want to get rid of properties as fast as they can,” said Patrick Newport, an economist at IHS Global Insight in Lexington, Massachusetts. “The key number driving foreclosures is the unemployment rate, and we saw that worsen in the second quarter.”

The unemployment rate in the three months ended June 30 rose to 9.1 percent from 8.9 percent, the first quarterly increase since 2009, according to the Labor Department.

California, Nevada

Home prices in June fell the most in the region that includes California, slumping 8 percent from a year earlier, the FHFA said. They decreased 7.9 percent in the area that includes Nevada and Arizona.

The month-over-month gain in prices exceeded analysts’ forecast of 0.2 percent, the median of 16 estimates compiled by Bloomberg. The region that includes Wisconsin, Illinois and Ohio had the biggest increase from May, with a 3.3 percent rise.

Mortgage rates for 30-year fixed loans fell to 4.15 percent last week, McLean, Virginia-based Freddie Mac said. The rate probably will average 4.6 percent this year, lower than 2010’s 4.7 percent, according to Fannie Mae in Washington.

Sales of U.S. previously owned homes dropped in July, reflecting an increase in contract cancellations due to strict lending rules and low appraisals, Lawrence Yun, chief economist of the National Association of Realtors, said Aug. 18. Purchases decreased 3.5 percent to a 4.67 million annual rate, the weakest since November.

Today’s FHFA report measures changes in real estate values using repeat data on individual properties with mortgages backed by Fannie Mae or Freddie Mac. It doesn’t include a dollar value for homes. The U.S. median home price was $171,900 in the second quarter, according to NAR.

Bloomberg

hostgator coupon 2011

In a cannon shot across Europe’s bows, he warned that Germany is reaching bailout exhaustion and cannot allow its own democracy to be undermined by EU mayhem.

“I regard the huge buy-up of bonds of individual states by the ECB as legally and politically questionable. Article 123 of the Treaty on the EU’s workings prohibits the ECB from directly purchasing debt instruments, in order to safeguard the central bank’s independence,” he said.

“This prohibition only makes sense if those responsible do not get around it by making substantial purchases on the secondary market,” he said, speaking at a forum of half the world’s Nobel economists on Lake Constance to review the errors of the profession over recent years.

Mr Wulff said the ECB had gone “way beyond the bounds of their mandate” by purchasing €110bn (£96.6bn) of bonds, echoing widespread concerns in Germany that ECB intervention in the Italian and Spanish bond markets this month mark a dangerous escalation.

He did not explain what else the ECB could have done once the bond spreads of these two big economies began to spiral out of control in early August, posing an imminent threat to monetary union and Europe’s financial system.

The blistering attack follows equally harsh words by the Bundesbank in its monthly report. The bank slammed the ECB’s bond purchases and also warned that the EU’s broader bail-out machinery violates EU treaties and lacks “democratic legitimacy”.

The combined attacks come just two weeks before the German constitutional court rules on the legality of the various bailout policies. The verdict is expected on September 7.

The tone of language from two of Germany’s most respected institutions suggests that both markets and Europe’s political establishment have been complacent in assuming that the court would rubberstamp the EU summit deals in Brussels.

Nobel laureate Joe Stiglitz told the forum that the euro is likely to fall apart unless Germany accepts some form of fiscal union. “More austerity for Greece and Spain is not the answer. Medieval blood-letting will kill the patient, and democracies won’t put up with this kind of medicine.”

Mr Stiglitz said Argentina’s 8pc annual growth rate after breaking its dollar peg in 2001 showed that “there is life after default, and life after breaking out of an exchange rate system”.

He warned that Germany is “going to lose a lot of money one way of another” since the exit of southern states will inflict large banking losses. The country might as well opt to shore up EMU and prevent its great dream of European unity “going down the drain”.

Chancellor Angela Merkel has struggled all this week to placate angry critics of her bailout policies within the Christian Democrat (CDU) party. Labour minister Ursula von der Leyen said countries that need rescues should be forced to put up their “gold reserves and industrial assets” as collateral, a sign that rising figures within the CDU are staking out eurosceptic positions as popular fury mounts.

Mrs Merkel insisted that this was “not the way to get things done” in the eurozone. She appears to have enough votes to back the EU summit deal in late July, which gives the bailout fund (EFSF) broader powers to shore up bond markets.

However, the simmering mutiny kills off any chance that Germany will agree to a major boost to the EFSF in coming months, let alone quadruple its firepower from €440bn to €2 trillion or more, the sort of figure deemed necessary by RBS, Citigroup and others to prevent the crisis engulfing Italy and Spain.

Marc Ostwald from Monument Securities said Germany is drifting towards a major constitutional crisis. “This has all the makings of the revolt that unseated Helmut Schmidt [in 1982], and indeed has political echoes of the inefficacy of the Weimar regime,” he said.

Mr Wulff said Germany’s public debt has reached 83pc of GDP and asked who will “rescue the rescuers?” as the dominoes keep falling. “We Germans mustn’t allow an inflated sense of the strength of the rescuers to take hold,” he said.

“Solidarity is the core of the European Idea, but it is a misunderstanding to measure solidarity in terms of willingness to act as guarantor or to incur shared debts. With whom would you be willing to take out a joint loan, or stand as guarantor? For your own children? Hopefully yes. For more distant relations it gets a bit more difficult,” he said.

The carefully-scripted comments are the clearest warning to date that Germany has reached the limits of self-sacrifice for Europe. The assumption that it will always - after much complaining - sign a cheque to keep the project of the road, no longer holds.

Fear that Germany’s torrid recovery from the Great Recession is already sputtering out is likely to harden feelings in Berlin.The IFO institute’s index of German business confidence saw the biggest one-month drop in August since the Lehman crisis in October 2008.

This follows a sharp fall in the ZEW financial index to -37.6, levels that have typically preceded recession in the past. German growth wilted to 0.1pc in the second quarter on falling export demand, though the figures may have been distorted by the stoppage of eight nuclear plants.

Mr Wulff rebuked Chancelor Merkel, saying political leaders should not break their holidays every time there is trouble in the markets. “They have to stop reacting frantically to every fall on the stock markets. They mustn’t allow themselves to be led around the nose by banks, rating agencies or the erratic media,” he said.

“This strikes at the very core of our democracies. Decisions have to be made in parliament in a liberal democracy. That is where legitimacy lies.”

hostgator coupon 2011

Video footage of Tatsuhiko Kodama's impassioned speech before a Diet committee in July went viral online recently, showing the medical expert's shocking revelation that the Fukushima No. 1 nuclear plant spewed some 30 times more radioactive materials than the fallout from the Hiroshima atomic bombing.

Kodama, a professor of systems biology and medicine at the University of Tokyo, used clear-cut terms to get his message across. His ruthless criticism of the government's slow response has been viewed at least 1 million times.

"It means a significantly large amount of radioactive material was released compared with the atomic bomb," he told the Diet committee.

"What has the Diet been doing as 70,000 people are forced to evacuate and wander outside of their homes?"

Despite a hard-nosed image, the expert on radiology and cancer briefly showed a softer side while speaking to The Japan Times about his two grandchildren and their summer in the Tokyo heat.

"A lot of people ask me this, but Tokyo is safe from radiation now," Kodama, who heads the university's Radioisotope Center and the Research Center for Advanced Science and Technology, said Aug. 12.

"My two grandchildren swim outside in the pool, and there is no concern with the safety of food at this point."

But his expression became grave when discussing the 20-km no-go zone in Fukushima, explaining that decontamination of such areas will take not years but decades.

There are places he wouldn't let his grandchildren spend time outdoors freely, even in areas outside of the restricted zone.

"Cesium has been detected from urine and breast milk from those residing in Fukushima Prefecture, and the cause for that is still not specified," he warned.

Kodama said he can't give an estimate of how many people will suffer from cancer symptoms due to exposure to radiation, or how long it will take for signs to surface.

There simply isn't enough epidemiological statistics to do that, he said.

But the government and scientists shouldn't be wasting time playing guessing games, he stressed.

"My theory is this — instead of trying to decide what is safe and what isn't at this point, we should focus on properly measuring the level of contamination in each area and on how to cleanse them."

According to Kodama, the Radioisotope Center estimates that radioactive materials released from Fukushima No. 1 amount to about 29.6 times of that released by the atomic bomb dropped on Hiroshima.

The group also found out that radiation from Fukushima will only decrease by one-tenth per year, which is about 100 times slower than radiation from the bomb.

The most difficult problem for the scientists trying to cope with the situation is that the Fukushima crisis is unprecedented.

"There are a lot of unknown (factors) regarding how this level of radiation will affect children and pregnant women," Kodama said, pointing out that the 1986 Chernobyl accident suggests the government should be on alert for any signs of bladder and thyroid cancer.

But apart from the aftermath of the Chernobyl incident, not many statistics are available to predict what may transpire, he said.

Still, that doesn't justify the government's slow response to Fukushima, he added.

For starters, the Diet has been extremely inept in updating laws on controlling radiation contamination.

While the Radiation Damage Prevention Law was created for handling small amounts of highly radioactive materials, specifically to handle accidents on site at nuclear plants, the Tohoku region is experiencing radioactive contamination in a radius beyond 200 km.

The situation calls for a completely different approach, yet the Diet has failed to update the prevention law.

That alone has been a major hindrance for scientists trying to diminish the damage in Fukushima, including Kodama, who pays visits to the prefecture every weekend to conduct decontamination efforts with his peers.

Another sign of a lax government can be seen in how local governments appear to be short of equipment to measure radiation contamination in food and other produce.

Considering that contamination will be a major problem for the next couple of decades, the central government shouldn't hesitate to invest in and develop, even mass-produce, equipment that can allow checks for radiation.

Some companies have told Kodama it would only take three months to develop a system for efficient radiation measurement.

Kodama advised the government to take two different approaches in decontaminating Fukushima.

The first step should focus on creating a rough map of the wider area and the level of contamination, possibly using remote-control helicopters and Japan's advanced GPS system.

For emergency decontamination procedures, each community should have a call-in center that conducts quick cleanups once a request is made from residents.

Kodama said the government has spent approximately ¥800 billion to decontaminate land after a mass cadmium poisoning broke out in Toyama Prefecture in 1912.

Contamination from radiation in the current crisis has spread to about 1,000 times that area, and the final cleanup cost is expected to be astronomical.

But both time and money should not be considered an issue, because it is the responsibility of this generation not to pass on the contaminated land to the next, Kodama said.

"I am aware that there are many opinions regarding nuclear power. However, I believe all of us can agree that Fukushima and the surrounding area needs to be decontaminated as soon as possible," he said.

Insurance on the debt of several major European banks has now hit historic levels, higher even than those recorded during financial crisis caused by the US financial group's implosion nearly three years ago.

Credit default swaps on the bonds of Royal Bank of Scotland, BNP Paribas, Deutsche Bank and Intesa Sanpaolo, among others, flashed warning signals on Wednesday. Credit default swaps (CDS) on RBS were trading at 343.54 basis points, meaning the annual cost to insure £10m of the state-backed lender's bonds against default is now £343,540.

The cost of insuring RBS bonds is now higher than before the taxpayer was forced to step in and rescue the bank in October 2008, and shows the recent dramatic downturn in sentiment among credit investors towards banks.

"The problem is a shortage of liquidity – that is what is causing the problems with the banks. It feels exactly as it felt in 2008," said one senior London-based bank executive.

"I think we are heading for a market shock in September or October that will match anything we have ever seen before," said a senior credit banker at a major European bank.

Despite this, bank shares rebounded on Wednesday, showing the growing disconnect between equity and credit investors. RBS closed up 9pc at 21.87p, while Barclays put on 3pc to 149.6p despite credit default swaps on the bank hitting a 12-month high. This mirrored the US trend, with Bank of America shares up 10pc in late Wall Street trade after a hitting a 12-month low on Tuesday over fears that it might have to raise as much as $200bn (£121bn). As with the European banks, the rebound in the share price was not reflected in the credit markets, where its CDS reached a 12-month high of 384.42 basis points.

European stock markets joined in the rally. The FTSE closed up 1.5pc at 5,206 on hopes the chance of a global recession had diminished. European shares hit a one-week high, with Germany's DAX closing up 2.7pc and France's CAC 1.8pc higher. The Dow Jones index edged higher on strong durable goods orders data as markets began to accept that the US Federal Reserve is unlikely to signal fresh stimulus at Jackson Hole this Friday.

Even Moody's decision to downgrade Japan's sovereign credit rating by one notch to Aa3 did little to damage global sentiment, although Tokyo's Nikkei closed down just over 1pc.

As stock market nerves settled, gold - which has recorded steady gains recently as investors seek a safe haven - fell 5.3pc to $1,777 in London.

The Telegraph