November 16th, 2012This week on 'The Hal Lindsey Report'As early as the mid-19th century, French philosopher and historian Alexis de Tocqueville warned that democracies will collapse once the majority realizes it can elect leaders who will give them free things. He said that all democracies die on the rocks of loose fiscal policies.

He also warned that the world's great civilizations only last about two centuries.

Well, we're working on our third century and the American electorate just got its first taste of the free goodies.

Some will argue that America has crossed the Rubicon; that the "gimme" generation has reached critical mass; that from this point on a majority of Americans will vote for a President based on what he will give them, not on how wisely he will lead the nation.

And the majority will vote this way because they are ensnared in the "entitlement trap." And not by accident, unfortunately.

What else could explain the re-election of a leader who failed miserably to accomplish anything he promised in his first campaign? Yet repeatedly and clearly guaranteed that, if re-elected, he would double-down on his failures.

Wait a minute. I stand corrected. He did come through on one promise: ObamaCare. And it may help bankrupt America -- which is not what he promised, but almost surely intended. (See the Cloward-Piven plan I described on "The Hal Lindsey Report" of July 9, 2010.)

Atlas Shrugged is a monumental novel written in the 1950's by Ayn Rand, an atheist and philosopher-type. Ms. Rand believed that Reason is god and that man is his own greatest achievement. She was also an unabashed capitalist.

Atlas Shrugged imagines a dark, depressing American future where government intervention into the economy causes further economic downturn that extends and deepens the existing depression. In looking for someone to blame for the nation's ills, the American leaders begin to blame the rich. They harass them for their ideas, initiative, profits, and wealth. Not to spoil the ending (although this is one of America's most famous novels so you probably already know the ending), but the "men of the mind" go on a silent strike by shutting down the "motor of the world", that is, their own inventiveness and industry.

In her epic work, Ms. Rand frames the confrontation as the "moochers and looters" versus the "inventors, workers, and the rich." When the creators of work and wealth finally get fed up with having their efforts burdened with regulation and their rewards confiscated and redistributed, they check out. Eventually their loss starves the government of its financial 'resources' and, literally, Manhattan goes dark.

Sound familiar?

Interestingly, Ms. Rand wrote the book in the '50's and one of the pivotal years in her futuristic scenario is 2016.

As we used to say, that kind of gives cause for pause. But I'm not sure we're going to make it to 2016. At least not on the path we're following now. One thing I can guarantee, though, is that the America of 2016 will be a far cry from the America of 2012. And not for the better, I fear.

What we've recently witnessed in our nation calls to mind two poignant scriptures. One from the Apostle Paul and the other from God Himself delivered through the Apostle John.

Paul famously described these days in his second letter to Timothy. He says in part, "There will be terrible times in the last days. People will be lovers of themselves, lovers of money, boastful, proud, abusive... ungrateful, unholy... without self-control... treacherous... conceited... lovers of pleasure rather than lovers of God...." I won't go on, but, believe me, it's a letter-perfect description of present day America. You can read it for yourself at 2 Timothy 3:1-5 (NIV).

The second passage is found in the Apostle John's Book of the Revelation. In it, God says to the church at Laodicea (which depicts the dominant characteristics of the Church just before the Rapture), "I know your deeds, that you're neither cold nor hot. I wish you were either one or the other! So, because you are lukewarm -- neither hot nor cold -- I am about to spit you out of my mouth." I won't finish the passage, but you can find it at Revelation 3:15-18 (NIV).

I think God's condemnation of Laodicea aptly fits many in today's Church. How else can we explain how 21% of American evangelical Christians justified voting to re-elect President Obama, the first American president to openly support abortion, same-sex marriage, the forcing of religious institutions to violate their moral and spiritual codes, and who displays open hostility toward Israel.

I can understand a Christian voting for Mister Obama the first time. After all, he cleverly disguised his true beliefs on these issues. But I think the fact that 6.5 million born-again Christians voted for those values -- after the President revealed his true convictions during his first term -- tells us we are nearing the end of the prophetic timeline. Just as Paul and John described.

I truly believe Americans are in for some rough days ahead. But all is not dark. As I said last week, God is still in control and everything is unfolding just as the Bible prophets predicted. Rough times are coming, but they're bringing with them unprecedented opportunities. Opportunities to see, up close, the hand of God at work. Opportunities to let Christ shine through your life and testimony. Opportunities to share the Good News of Jesus Christ with those who are discouraged, dismayed, and disappointed with how things are turning out.

Should Jesus delay His coming, the next few months and years will be the true Church's greatest opportunity to reap a bountiful harvest of souls for God's Kingdom. Let's be ready for the moment and share the truth about Jesus Christ in boldness and joy. Take the scripture at face value. Speak the name of Jesus and speak the Word of God to others. It is "living and powerful and sharper than any two-edged sword...." It unleashes the power of the Holy Spirit to work in any situation, no matter how big or small.

By boldly sharing the claims of Christ and speaking the Word of God into someone's life, you're putting the ball in the Holy Spirit's hands -- and the Bible promises that He's quite capable of taking it from there.

If we "crack the faith barrier" and trust God's Word, I think the dark days ahead may well be the brightest yet.

Please have a wonderful Thanksgiving. In spite of all that is happening in America, it is still the most blessed nation on earth. God bestowed upon all of us who are fortunate enough to live here a truly magnificent favor. Thank you, Heavenly Father, for this wonderful land and all of Your blessings. May gratitude reign in our hearts.

Hal Lindsey

Not happy with building mysterious gigantic structures in the desert, the Chinese are now building inter-dimensional portals in the middle of their cities. I mean, come on, what the hell is this 157m high metal structure in the the city of Fushun, in northeast China’s Liaoning province?

It’s made of an astounding 3000 tons of steel and it will glow at night — decorated with 12,000 LED lights. According to Fushun Municipal Government’s officials, this titanic structure does absolutely nothing except serve as an elevated sighting position. They claim it is pretty “landscape architecture” — like the Eiffel Tower. It uses four elevators to take people to the top.

The Chinese media has been harsh about the building after a blogger posted these photos on Sina Weibo, which is the country’s “largest microblog platform”. Not surprising, since this thing costs $US16 million.

According to Fushun’s Urban Construction Bureau, the “Ring of Life” means “a round sky and a path leading to a paradise in heaven.”

I believe it. And so does the internet. Check out the photoshops at the end of this post.

Gizmodo Australia

They say: You should not have gold, everything it's fine".... but they are buying it at record amount!!!

Gold’s 12-year rally, the longest in at least nine decades, is poised to continue in 2013 as central bank stimulus spurs investors from John Paulson to George Soros to accumulate the highest combined bullion holdings ever.

The metal will rise every quarter next year and average $1,925 an ounce in the final three months, or 11 percent more than now, according to the median of 16 analyst estimates compiled by Bloomberg. Paulson & Co. has a $3.66 billion bet through the SPDR Gold Trust, the biggest gold-backed exchange- traded product, and Soros Fund Management LLC increased its holdings by 49 percent in the third quarter, U.S. Securities and Exchange Commission filings show.

Central banks from Europe to China are pledging more steps to boost growth, raising concern about inflation and currency devaluation. Investors bought 247.5 metric tons through ETPs this year, exceeding annual U.S. mine output. While both sides said talks Nov. 16 between President Barack Obama and Congress over the so-called fiscal cliff were “constructive,” the Congressional Budget Office has warned the U.S. risks a recession if spending cuts and tax rises aren’t resolved.

“We see gold as a hedge against the follies of politicians,” said Michael Mullaney, who helps manage $9.5 billion of assets as chief investment officer at Fiduciary Trust in Boston. “It’s a good time to garner some protection in portfolios by having some real asset like gold.”

Bloomberg

The failure of eurozone ministers to reach a deal to give Greece its latest bailout payment threatens the whole bloc, leaders have said.

Following nearly 12 hours of talks in Brussels, the Eurogroup said it needed more time for technical work.

Greek Prime Minister Antonis Samaras said: "It's not only the future of our country, but the stability of the entire eurozone [that is at stake]."

France's finance minister insisted they were a "whisker" away from a deal.

The chairman of the Eurogroup, Jean-Claude Juncker, said ministers would meet again next week.

"Greece did what it had to do, and what it had pledged to do... whatever technical difficulties in finding a technical solution do not justify any negligence or delay," Mr Samaras said.

Greece needs the next tranche of its second bailout worth 130bn euros ($166bn; £104bn) to avoid insolvency.

The eurozone "would be threatened if we did not reach" a deal, French Finance Minister Pierre Moscovici said, before adding that "we are very close to a deal."

"We have observed that Greece had made considerable efforts," he told Europe 1 radio.

The eurozone finance ministers have been considering ways of reducing Greece's public debt, which is projected to rise to 189% of gross domestic product (GDP) by next year.

"We believe that, eventually, eurozone leaders will agree on a deal to cut Greek debt substantially," said Martin Koehring of the Economist Intelligence Unit.

"It is not in their interest to push Greece out of the eurozone over technical disagreements. A much more likely cause for a Greek disorderly default and euro exit would be domestic political developments in Greece, highlighted by rising political instability and social unrest.

"However, our assessment remains that there is a 40% probability that Greece leaves the eurozone within the next five years."

Disagreement

The country's bailout programme aims to get debt down to 120% of GDP by 2020.

There has been disagreement among the ministers and the International Monetary Fund, Greece's other bailout creditor, on how to make the country's debt manageable.

"The Eurogroup has had an extensive discussion and made progress in identifying a consistent package of credible initiatives aimed at making a further substantial contribution to the sustainability of Greek government debt," Jean-

Schroders economist Virginie Maisonneuve: "Clearly we'll have more negotiation"

The eurozone ministers favour giving Greece an extra two years, to 2022, to bring its debt to 120% of GDP, but the IMF has resisted that extension.

Although the meeting wrapped up in the early hours of Wednesday morning in Brussels without a conclusion, earlier on Tuesday night there had been optimism a deal would be reached.

The French finance minister Pierre Moscovici said: "I have the impression that a political agreement is within reach."

The managing director of the IMF, Christine Lagarde, insisted: "We're going to work very constructively to see if we can find a solution for Greece. That's what really is our goal, our purpose and our mission."

So far, Greece has received nearly 149bn euros (£119bn; $191bn) from the eurozone and the International Monetary Fund, out of 240bn euros that has been approved in two bailout loans.

BBC

BEIJING, November 21 (RIA Novosti) – Russian Defense Minister Sergei Shoigu on Wednesday indicated Russia’s continuing interest in cooperation with China on defence sector issues.

Shoigu told top Chinese officials during a visit to Beijing for the 17th Sino-Russian Intergovernmental Commission on Military and Technological Cooperation that joint work between the two powers would enhance stability across the region.

“The closer the cooperation is between our two countries, including in the military-technological area, the more peaceful our region will be,” he said.

This was Shoigu's first official foreign trip since replacing Anatoly Serdyukov as defense minister earlier this month.

Senior Chinese military officials in turn indicated their support for closer cooperation with Moscow.

“We see our relationship with Russia as a priority in the field of international military cooperation,” said Xu Qiliang, deputy head of the Communist Party of China’s Central Military Commission.

He added that Beijing wishes to "bring the relationship to a higher level."

As China's economy and influence have continued to grow, the country has become increasingly attractive to Moscow as a regional partner. The two powers already have alligned interests in foreign policy - from batting down Western criticism of human rights abuses to their joint stance against foreign intervention in the Syrian civil war.

RIA Novosti

The global economy is likely to be stuck in the “twilight zone” of sluggish growth in 2013, Morgan Stanley has warned, but if policymakers fail to act, it could get a lot worse.

The bank’s economics team forecasts a full-blown recession next year, under a pessimistic scenario, with global gross domestic product (GDP) likely to plunge 2 percent.

“More than ever, the economic outlook hinges upon the actions taken or not taken by governments and central banks,” Morgan Stanley said in a report.

Under the bank’s more gloomy scenario, the U.S. would go over the “fiscal cliff” leading to a contraction in U.S. GDP for the first three quarters of 2013. In Europe, the bank’s pessimistic scenario assumes a failure of the European Central Bank (ECB) in cutting rates and a delay of its bond-buying program.

But the bank says investors should also be nimble, in case policy action is “convincing and decisive,” leading to a big uptick in growth.

“Importantly, investors should keep an open mind and be prepared to switch between the scenarios as policy developments unfold.”

The bank’s most optimistic scenario forecasts GDP growth of 4 percent in 2012 compared to around 3.1 percent this year.

Morgan Stanley isn’t alone in warning about a recession next year. Noted bear, Nouriel Roubini warned on Monday that certain key developments would exacerbate the downside risks to global growth in 2013.

“Until now, the recessionary fiscal drag has been concentrated in the euro zone periphery and the U.K.. But now it is permeating the euro zone’s core,” Roubini wrote. “And in the U.S., even if President Barack Obama and the Republicans in Congress agree on a budget plan that avoids the looming “fiscal cliff,” spending cuts and tax increases will invariably lead to some drag on growth in 2013 – at least 1 percent of GDP.”

Roubini said the rally in global markets that begun in July was now running out of steam as global growth slows and valuations look stretched.

“Price/earnings ratios are now high, while growth in earnings per share is slackening, and will be subject to further negative surprises as growth and inflation remain low. With uncertainty, volatility, and tail risks on the rise again, the correction could accelerate quickly.”

CNBC

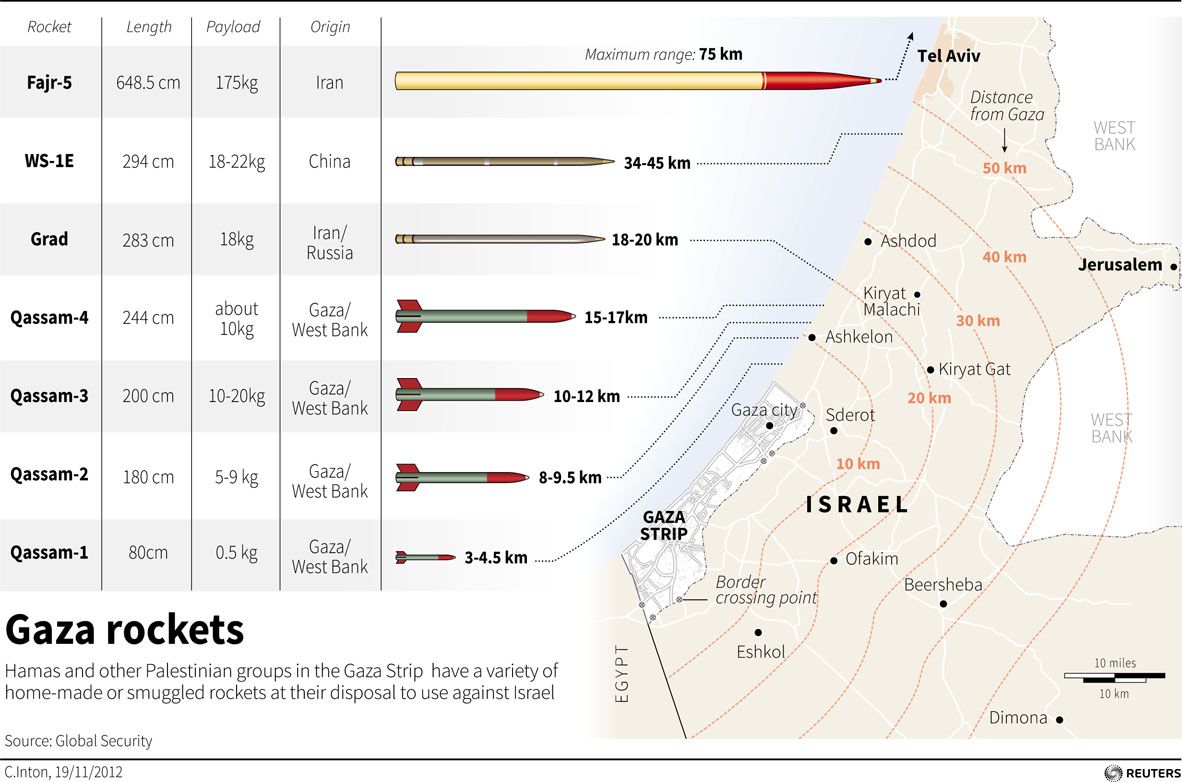

Gazan fire killed an IDF soldier and an Israeli civilian on Tuesday, as over 140 rockets rained down on Israel throughout the day.

Cpl. Yosef Partuk, 18, of Emanuel was killed Tuesday morning in a mortar attack in the Eshkol Regional Council area, the IDF released for publication Tuesday evening. Partuk was posthumously promoted to corporal. The civilian killed was a Beduin from one of the South's unrecognized villages.

The announcements came on the heels of a Gaza rocket attack that lightly injured six people after striking an apartment building in the central city of Rishon Letzion.The upper floors of the building went up in flames, according to Channel 2.

Also Tuesday evening, a person was moderately to seriously wounded when a rocket fired from Gaza struck a building in Ashkelon.

That attack followed a barrage of rockets fired at Ashdod, in which seven people were lightly injured after two direct rocket hits on the city, including one that completely destroyed a grocery store.

Earlier Tuesday, two rockets fired from Gaza towards Jerusalem landed in the Gush Etzion region, with one hitting an open area of a Palestinian village in the West Bank, police and the IDF reported. It was unclear if the rocket caused any damage or injuries, although AFP reported Palestinian paramedics made their way to the scene.

The rocket set off the warning siren in the nation's capital for the second time since the start of Operation Pillar of Defense. The two rockets that set off the first such siren on Friday also landed outside the city.

Also on Tuesday, a salvo of rockets and mortars moderately wounded a reserve Armored Corps IDF officer near the Gaza border. Emergency forces evacuated the officer to Soroka Medical Center in Beersheba.

Palestinians fired some 20 rockets at Beersheba Tuesday morning, following a relatively quiet night on the home front. The Iron Dome missile defense system intercepted at least 11 of the Grad rockets but three struck the city, damaging a bus, homes and a car but causing no injuries.

Dozens more Palestinian rockets flew toward southern Israel throughout Tuesday, with direct hits also reported in Kiryat Malachi and Sderot. Iron Dome intercepted at least five rockets on trajectories toward populated areas.

The Israel Air Force has struck more than 1,400 targets in Gaza since Operation Pillar of Defense, entering its seventh day on Tuesday, began with the targeted killing of Hamas military chief Ahmed Jabari last Wednesday.

MDA forces have dealt with over 252 casualties since the beginning of the Gaza operation, including three killed by a rocket in Kiryat Malachi and 21 injured as a result of falling shrapnel. Iron Dome has intercepted more than 350 rockets in total since the start of the operation.

Jerusalem Post

Ben Bernanke, the chairman of the Federal Reserve, has warned that the fiscal cliff poses a "substantial threat" to the US recovery.

In his first speech since president Barack Obama's re-election, Bernanke said that the year-end expiration of Bush-era tax cuts and imposition of deep spending cuts would send the US "toppling back into recession."

Speaking at the New York Economic Club, Bernanke called the US recovery "disappointingly slow". He added: "Indeed, since the recession trough in mid-2009, growth in real gross domestic product (GDP) has averaged only a little more than 2% per year."

He acknowledged some positive indicators: the job market continues to improve, inflation remains low and the housing market appears to be improving. But Bernanke said the Federal Reserve remained concerned about the fragility of the recovery, not least because of threats from abroad.

"The elevated levels of stress in European economies and uncertainty about how the problems there will be resolved are adding to the risks that US financial institutions, businesses, and households must consider when making lending and investment decisions," Bernanke said.

He also said the row over the fiscal cliff presented a major challenge to the US economy. "The realization of all of the automatic tax increases and spending cuts that make up the fiscal cliff, absent offsetting changes, would pose a substantial threat to the recovery – indeed, by the reckoning of the Congressional Budget Office (CBO) and that of many outside observers, a fiscal shock of that size would send the economy toppling back into recession."

In his speech, Bernanke warned that a row over increasing the US debt ceiling in Washington would have dire consequences. A row over raising the debt limit in the summer of 2011 led to a historic downgrade of US debt by ratings agencies and triggered panic on financial markets around the world. "A failure to reach a timely agreement this time around could impose even heavier economic and financial costs," said Bernanke.

David Semmens, senior US economist at Standard Chartered, said the speech signaled the Fed was unlikely to raise interest rates any time soon. "This is certainly a speech that is signally the risks remain firmly to the downside. We are likely to see the Fed on hold for longer rather than shorter and that they will only be hiking when they are assured of a self-sustaining recovery," he said.

Guardian

Suicides among active-duty forces across the military are now occurring at a rate faster than one per day.

7:46PM EST November 18. 2012 - With six weeks left in the year, the Army and Navy are already reporting record numbers of suicides, with the Air Force and Marine Corps close to doing the same, making 2012 the worst year for military suicides since careful tracking began in 2001.

The deaths are now occurring at a rate faster than one per day. On Nov. 11, confirmed or suspected suicides among active-duty forces across the military reached 323, surpassing the Pentagon's previous high of 310 suicides set in 2009.

Of that total, the Army accounted for 168, surpassing its high last year of 165; 53 sailors took their own lives, one more than last year.

The Air Force and Marine Corps are only a few deaths from record numbers. Fifty-six airmen had committed suicide as of Nov. 11, short of the 60 in 2010. There have been 46 suicides among Marines, whose worst year was 2009 with 52.

"We continue to reach out to and embrace those who are struggling," the Army's chief personnel officer, Lt. Gen. Howard Bromberg, said in a statement Sunday. "We've taken great strides to prevent suicides, but our work isn't done."

Military and medical leaders have been searching for answers to what Defense Secretary Leon Panetta describes as an "epidemic" of suicides ever since the numbers began increasing among soldiers and Marines in 2005.

Military suicide researcher David Rudd sees a direct link with the effects of combat and frequent deployments.

"The reason you're going to see record numbers is because these wars are drawing down and these young men and women are returning home," Rudd said. "When they return home, that's where the conflicts surface."

While post-traumatic stress disorder was not a factor in large numbers of suicides, data show, among nearly 85% there were failed relationships, something linked to frequent separations.

Still, at at least a third of soldiers who killed themselves this year never went to war, and some leaders draw a correlation with societal stress, perhaps related to the poor economy.

"This is not just a military issue or an Army issue," said Gen. Lloyd Austin III, Army vice chief of staff.

"Across the military, we're a microcosm of what's in the nation," said Navy Vice Adm. Martha Herb, director personnel readiness.

The trend in suicides now seems to be impacting the branches that have had fewer troops in combat: the Navy and Air Force.

Suicide rates for the military, while rising, have remained lower than for the general population until this year. The current rate for the Army is close to 30 per 100,000, outpacing an estimated 24-per-100,000 rate among a demographically similar civilian population, according to military statistics.

The record-setting numbers reported by the military pertain only to active duty troops. The Army, for example, has recorded an additional 114 suicides among G.I.s in the National Guard or Reserve who were demobilized — its citizen soldiers.

When Army suicides among those on active duty and demobilized status are combined, the number exceeds the 207 soldiers who have died so far this year in Afghanistan, a difference further skewed because some of those combat zone deaths were also suicides.

The military in recent years has invested more than $50 million in research efforts to produce evidence-based tools for preventing suicide.

Among the first studies is one involving 50 soldiers who attempted suicide at Fort Carson, Colo. It recently found that by teaching them meditation and relaxation skills to manage emotions and relationships, suicidal behavior was dramatically reduced, said Rudd, who is leading the research.

"We weren't thinking about the issue as really one of curing mental illness," he said. "(It) is about installation of hope."

USA Today