Good Monday Morning, the world’s stock markets are in free fall and the banks and their worthless paper currencies are next!!!

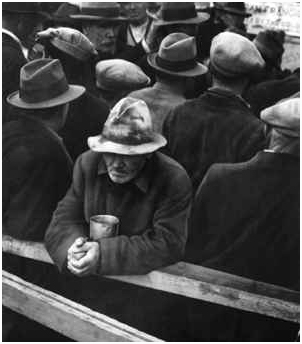

The world is in the middle of a global economic meltdown. What does that mean? The simple answer is that it will not be long until every modern country is consumed by hyperinflation resulting in the crash of most of the paper currencies on the planet. This will result in an economic shutdown. Starvation will become commonplace. Unrestrained violence will occur and eventually the world will slip into World War III.

I literally have at my finger tips two dozen economic indicators which demonstrates that total and global economic collapse is at hand. In the interest of brevity, I will only highlight two of these indicators and if these were the only indicators, an economic collapse would still be in our collective futures.

A Dead Global Economy

Three weeks ago

Reuters reported that shipping freight rates for transporting containers being transported from the ports in Asia to Northern Europe dropped almost 23% to $400 per 20-foot container in the week ended on August 3, 2015 and the data was obtained from the Shanghai Containerized Freight Index. At that time, at least the crippled Baltic Dry Index was holding its own. That is not longer the case. The BDI is in total free fall. Oil prices are in free fall. Very little is moving. The Chinese Stock Market is disintegrating before our eyes. Read this chart and weep. This is the end. There will be no more warnings, only progress reports about the collapse. According to the BDI product is NOT moving!

According to this chart, very soon, nothing will be moving. This means catastrophic food shortages. Medicines will not be shipped. Those who still have jobs will not be able to drive to work. This is why China devalued its currency. And in retaliation, this is China was attacked, twice, this past week. The point of no return has been reached.

To those that are not economically not savvy to the importance to the BDI, I have prepared a brief explanation below.

The Baltic Dry Index

The Baltic Dry Index (BDI) is absolutely the best measure of global economic health.

The Baltic Dry Index (BDI) is absolutely the best measure of global economic health. The BDI is used by economists as a leading global economic indicator because it predicts future economic activity. The BDI, uses the U.S. dollar as a benchmark and measures the global supply and the corresponding demand for commodity shipments among bulk carriers. Commodities, in the form of raw materials like grains, lumber, coal and precious metals form the backbone of the BDI. Over time, the BDI is the best indicator of global economic health because,

unlike the futures market, the BDI does not engage in speculation as it provide near real time data on what and what is being shipped. The determinations made by the BDI are such an accurate indicator of economic activity because businesses don’t book freighters when they have no cargo to move. In short, the BDI is the world’s financial blood pressure measure. The BDI is said to be one day away from reaching its all-time low. Ultimately, what the BDI tells economists is that we are headed for a depression that will make 1929 look like a picnic.

Back in February of 2015, the

BDI had fallen on 43 of the past 47 days because of a shipping strike. Back in February, the world was days away from a total economic shutdown. However, the crisis was resolved and product began to move and the world bought a few more moments of relative peace.

If Product Does Not Get Shipped, You Do Not Eat!

Let’s look at this issue through the lens of common sense. If raw materials are not being transported in sufficient numbers as the BDI strongly indicates, what will happen to manufacturing? To the cognitive dissonance crowd, please take off your rose colored sunglasses and honestly answer this question, what does a low BDI mean to manufacturing? Low BDI means low manufacturing, period! In turn this means less finished products coming to market. Please note that the BDI includes grains in its analysis. With fewer grains being shipped to market to be packaged and distributed to your grocery outlet, this will lead to severe food shortages. This is not fear-mongering, this is simple Economics 101. Look at the chart representing the collapse of the BDI and ask yourself, where will your Thanksgiving turkey come from?

When the full effect of this impending train wreck is felt, there will not be a government in the civilized world that will be safe from assassination. I know, some of you will say that this will never happen. Well, let’s take a look at what Paul Craig Roberts and Sam Ro said back in February about the conditions in Greece.

European Union Economic Crisis

Two days ago, the Euro declined 1.3% in one day versus the dollar, leaving many European banks fearing that the bottom is falling out of the European Union’s economy.

Business Insider’s Sam Ro stated that Greek banks can no longer exchange Greece’s lowly-rated government bonds for money in the European Union. In other words, the European Union just announced the Greece’s money is worthless. What keeps an economy, in distress, rolling on day after day? The reasons are purely psychological. One Greek accepts Greek bank notes from another Greek because they have confidence that the paper currency can be exchanged for goods and services. When Greek citizens loses confidence in their ability to flip the paper money in exchange for goods and service, the Greek economy will totally collapse. The European Union’s recent decision to not honor Greek paper currency has set into effect a series of dominoes which will culminate in the Greeks not having a paper currency for daily use. Unless the European Union reverses their position, the Greek economy could be days away from total collapse. And under these highly volatile circumstances, anarchy would ensue.

The situation in Greece is so dire that Paul Craig Roberts is openly talking about the real possibility that the Greek government will be assassinated. Roberts believes that it is very possible that the Greek people will turn their back on the West and will accept Russia’s offer to become a member of the BRICS, under the Russian sphere of influence as

Robertsindicated.

“That makes it difficult to make an agreement with the new Greek government to ameliorate the conditions imposed on Greece. So it makes the EU inflexible. That inflexibility gives Greece the cards to say, ‘We’re not playing your game — we’re going to play a different game and accept Russia’s offer.”

To make matters worse global oil prices are plummeting as well in this double whammy which will result in nothing being shipped.

Eurozone collapse is inevitable.

Spain and Ireland’s economy are on the verge of collapse and have been since the summer of 2015. Germany, France and Italy would be better off to be in the Russian sphere of influence given their dependence on Russian gas shipments to these three economies. In short, the European Union will not survive. If the EU is still here in Thanksgiving, I am going to be very surprised.

Although the date of the death of the European Union has yet to be determined. However, it is only a matter of time. And if Paul Craig Roberts assertion that when the Greek government will be assassinated in the coming anarchy, how long will it be until the violence crosses into Spain, Ireland, Italy and then consumes the rest of Europe? And do you expect Putin to idly stand by and not take advantage of the chaos? Stalin would have been salivating at this coming opportunity.

The incompatibility of Muslim immigration has already brought violence to the streets of Sweden, France and several other European countries will exacerbate the economic conditions. Europe is primed and ready for a total meltdown and with the health of the American economy, there is no way that we can save financial backsides of our training partners. At the end of the day, I think Paul Craig Roberts prediction may be tame. The Greek government will not be the only government running for cover when the proverbial economic poop hits the fan, the violence will spread across Europe like Ebola across West Africa.

Summary

Do you think the September date associated with the Pope addressing the United Nations is a coincidence? I recommending that all of us plan accordingly. Does this make Jade Helm’s purpose a little more clear?

Four Hundred of the world’s richest people lost a total of $182 billion this week, amounting to 6.3% of their total and collective wealth. These people are the last line of economic defense, it is over! And what do rich people do when the money begins to run out? ANSWER: THEY START WARS!!!

The Commodities market is at a 13 year low! The only thing that is increasing in value is gold!

These numbers make 2008 look like an economic boom!!!

Are you prepared for what is coming? Have you stored food, water and made agreements of protection with your neighbors. Are you and your family spiritually prepared? It is 30 seconds to midnight, we are out of time.

In summary, I will reiterate what I have said many times before:

This bankster run system does not work for you and me. Buy gold and silver!!!!! Again, take your money out of their banks, stop shopping in globalist stores like Walmart and begin to trade and barter and grow your own food. To do otherwise, is to continue to participate in a rigged game which will culminate in your destruction!

Credit to Common Sense