Wednesday, June 6, 2012

EU Expects Spanish Bank Bailout Loans To Be Double The €40 Bn Previously Disclosed

While the Reuters story, which we noted earlier, and which speculated that a no-strings attached bailout of Spanish banks may be coming courtesy of a German stealth funding of the nearly empty Spanish bank bailout fund, has been making the rounds over and over, the latest incarnation of the underlying narrative, brought to us courtesy of the FT, has a novel twist: "EU officials are also debating the size of the loans needed. Senior Spanish banking executives have put the figure at about €40bn, but EU officials have been looking at plans that are at least double that, according to people briefed on the discussions." In other words, just as we speculated, Goldman's big picture estimate of Spanish bank funding needs was woefully inadequate, and once the dirty truth is uncovered, it will become apparent that losses, which at this point are nothing more than capital shortfalls from deposit runs, are far, far greater than anyone speculated.

It also means that the disconnect between the European reality, and what the media and politicians are spoonfeeding the gullible public, has hit unprecedented levels. Finally, once Germans once again realize they have been lied to, what happens then: will they simply fork over the cash as rumored, or will they finally say enough? According to this lead article in German Welt, the answer is not looking too good for the broken European monetary experiment.

From the FT:

Spanish officials and bank regulators are confident that the IMF will conclude that the recapitalisation needs of the country’s banks – principally the former cajas that make up Bankia, Catalunya Caixa and NovaCaixaGalicia – will be more modest than many foreign analysts assume.

Despite the urging of Brussels and Paris, officials said direct bailout loans to troubled banks – bypassing the Spanish government – have been ruled out. Regulations for the current €440bn eurozone rescue fund and its permanent €500bn successor forbid such direct capital injections and changing the rules would take too long to come quickly to Madrid’s assistance.

Instead, one of the options under consideration is to provide the bailout aid directly to Spain’s bank rescue fund, known by its Spanish initials Frob.

If required, the European Financial Stability Facility, the eurozone’s bailout fund, could rapidly inject bonds directly into Frob.

Naturally, the biggest problem with this scheme, is that it simply plugs a leaking vortex: as more Spanish real estate losses bubble to the surface, and more deposits are withdrawn, more, and more, and more cash will have to be provided by Germany. And today's initial doubling of bailout estimates is just the beginning: the final cost before German taxpayers finally revolt in disgust with what is nothing but a direct Spanish bank bailout, will be orders of magnitude higher. And so the sunk costs of Europe's continental bailout will continue to soar.

But why?

“Eurozone member states have an incentive to design a programme that would emphasize banks and be ‘conditionality light’ to facilitate Rajoy’s ability to manage his domestic constraints,” said Mujtaba Rahman, a Europe analyst at the Eurasia Group risk consultancy. “The longer the Spanish situation drags out, the greater is the risk that Italy will also come back into play.”

And there you have it: at the end of the day, it is all about preventingdelaying the realization that the Italian financial sector is just as broke as that of Spain.

Needless to say, a Spanish FROB refill won't halt the crisis. It will merely delay it. And the outcome will still be the same. But at this point delaying the inevitable collapse is really the only option Europe has. If it means some more Germans lose what is left of their wealth, so be it.

Zero Hedge

From the FT:

Spanish officials and bank regulators are confident that the IMF will conclude that the recapitalisation needs of the country’s banks – principally the former cajas that make up Bankia, Catalunya Caixa and NovaCaixaGalicia – will be more modest than many foreign analysts assume.

Despite the urging of Brussels and Paris, officials said direct bailout loans to troubled banks – bypassing the Spanish government – have been ruled out. Regulations for the current €440bn eurozone rescue fund and its permanent €500bn successor forbid such direct capital injections and changing the rules would take too long to come quickly to Madrid’s assistance.

Instead, one of the options under consideration is to provide the bailout aid directly to Spain’s bank rescue fund, known by its Spanish initials Frob.

If required, the European Financial Stability Facility, the eurozone’s bailout fund, could rapidly inject bonds directly into Frob.

Naturally, the biggest problem with this scheme, is that it simply plugs a leaking vortex: as more Spanish real estate losses bubble to the surface, and more deposits are withdrawn, more, and more, and more cash will have to be provided by Germany. And today's initial doubling of bailout estimates is just the beginning: the final cost before German taxpayers finally revolt in disgust with what is nothing but a direct Spanish bank bailout, will be orders of magnitude higher. And so the sunk costs of Europe's continental bailout will continue to soar.

But why?

“Eurozone member states have an incentive to design a programme that would emphasize banks and be ‘conditionality light’ to facilitate Rajoy’s ability to manage his domestic constraints,” said Mujtaba Rahman, a Europe analyst at the Eurasia Group risk consultancy. “The longer the Spanish situation drags out, the greater is the risk that Italy will also come back into play.”

And there you have it: at the end of the day, it is all about preventingdelaying the realization that the Italian financial sector is just as broke as that of Spain.

Needless to say, a Spanish FROB refill won't halt the crisis. It will merely delay it. And the outcome will still be the same. But at this point delaying the inevitable collapse is really the only option Europe has. If it means some more Germans lose what is left of their wealth, so be it.

Zero Hedge

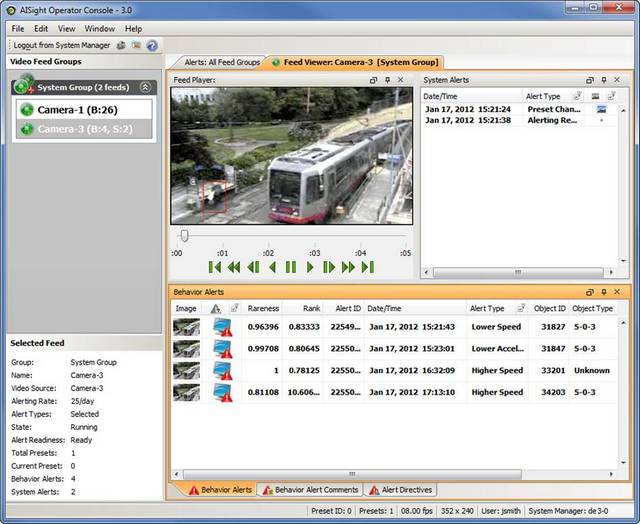

Mass Transit Cameras Spot Bad Guys with No Human Judgment Required

A new breed of security cameras can supposedly detect terrorism and crime without a human judgment call--and mass transit agencies are shelling out big bucks for the product. San Francisco's Municipal Transit Authority, which oversees the city's MUNI trains, has signed a contract with security firm BRS Labs to deploy cameras to 12 subway stations that use algorithms and machine learning techniques to spot anomalous behavior.

BRS Labs is a security firm that provides behavior recognition software for video surveillance. The company's clients include government, tourist attractions, military bases, and private industry; BRS's software issues real-time text alerts when cameras detect strange behavior. Servers connected to security cameras observe locations for weeks at a time and then establish a baseline of “normal” behavior based on this timespan; anomalous activities afterwards (loitering, abandoned packages, abnormally high/low numbers of passengers) trigger an alert. No tripwires or programming of initial parameters are required.

According to a publicly available product bid, the San Francisco MUNI project will include up to 22 connected cameras at each train station; video monitoring will be conducted by train control, MUNI Metro East facility, and in-station personnel. The video systems will build memories of observed behavior patterns that mature with time; the systems, in the bid's words, “[have] the capability to learn from what [they] observe.”

In an interview with Fast Company, BRS Labs President John Frazzini said that the company's AIsight behavior recognition product relies on 11 patents related to computer vision technology and surveillance imagery. BRS's patents primarily deal with the intersection between computer vision and machine learning; video footage grabbed by MUNI cameras will be automatically translated into code for real-time processing. Clips of anomalous activity are dispatched to MUNI employees automatically; SMS text message alerts are also sent to staffers' mobile phones.

The post-9/11 emphasis on “homeland security” and anti-terrorism efforts has resulted in a gold rush of surveillance contracts from mass transit agencies and public institutions nationwide. While large mass transit agencies such as New York's MTA and Chicago's CTA have been cagey about their counter-terrorism efforts, trade show presentations and chatter in industry publications have given a basic idea of what is happening. Apart from machine learning-based video surveillance, subway security has also taken on wackier (and scarier) aspects: The Homeland Security Department has publicly announced their plans to release bacteria into Boston T tunnels this summer in order to test new biological weapon detectors deployed throughout the subway system.

The same technology that's being deployed in San Francisco's subway is also intended for the global market. BRS, which is based in Houston, has overseas offices in London, Sao Paulo, and Barcelona. BRS Labs' AISight product is primarily intended for use in counter-terrorism efforts. AISight's software algorithm has limited success in detecting in-station muggings or subway perverts, two issues of much more immediate interest to mass transit ridership than terrorist attacks.

Another unique aspect of BRS's product is the fact that it heavily relies on timestamps and time recognition. Behavior and objects are coded according to the times of day or days of the week in which they most frequently occur; the velocity, acceleration, and path of customers passing through a station are analyzed as well. Spatial anomalies and classification anomalies are taken into account as well.

One worrying--or appealing to budget-minded clients--aspect of BRS's product is the fact that their software product sharply reduces the need for human camera maintenance. The algorithms behind AISight compensate for lighting changes, shaky images, and poor bandwidth. Between the automated evaluation of “anomalies” and their software-based maintenance process, the need for human supervision for effective software operation sharply declines.

Fast Company

Gantz: Israel super ready to attack Iran if needed

Israeli preparedness to attack Iran is a major deterrent, IDF Chief of Staff Lt.-Gen. Benny Gantz told the Knesset Foreign Affairs and Defense Committee on Tuesday.

Gantz listed reasons Tehran may give up on nuclear weapons, such as “the vectors of international diplomatic isolation, economic pressure and sanctions, disturbances to the [nuclear] project that I won’t get into and a credible military threat.”

He added that “in order to be a credible military threat, we must be super-ready – and as far as I’m concerned, we’re super-ready.”

The IDF chief explained that Iran had yet to determine whether to use its nuclear capabilities for weapons, and only Tehran could make that final decision. The IDF is prepared for either scenario, he said.

“There is a lot of chatter and public debate on this matter,” he pointed out. “The Iranian issue – capabilities or lack thereof, how things are developing and where it’s going – is very dynamic, and very few people know what is possible or impossible.”

Gantz said many people claimed to know what was happening, but they did not, and the public debate and professional debate were far from each other.

“Some people used to know, and they don’t today,” he stated, in reference to former defense establishment officials like former Mossad chief Meir Dagan and former Shin Bet (Israel Security Agency) chief Yuval Diskin, who have said an attack on Iran would not be effective.

Gantz also said the IDF was concerned about arms smuggling between Hezbollah and Syria, noting that there was more movement than ever before and that Iran and Hezbollah were very involved in Syria.

Instability on the Golan Heights has increased as a result of the situation in Syria, as have the security issues near the border, although there has not yet been any terrorist activity, he said.

The chief of staff called Syria a “lose-lose situation,” because if Syrian President Bashar Assad were to fall, radical elements would take over. If he remains in power, he will be weak, Gantz continued, and there will be instability.

“Good things won’t happen in Syria,” the IDF chief said, explaining that there was likely to be an increase in arms smuggling in either case.

He also called for the IDF to compile a multi-year plan with an increased budget, saying that at present the military was “floating like a raft, not sailing like a boat.”

“The framework of the budget does not allow a reasonable continuation of a multi-year plan in the complex strategic reality and negative trends,” he stated. “We must ensure our ability to attack from the air and ground at the same time. I must ensure that the active units are not hollow and can fulfill any mission.”

Gantz added that he had total faith in the air force and intelligence, but that he must make sure to preserve their power.

Jerusalem Post

Apocalyptic fish kill reported off the coast of Japan

June 6, 2012 – JAPAN – Something terribly fishy is going on at the fishing port of Ohara (pronounced Oh-hara) in Isumi City of Chiba Prefecture, and it has nothing to do with espionage or political corruption.

There are tons and tons of dead sardines washing up on the shore, and not only is the sight disturbing, but the huge amount of dead fish is literally smelling up the entire surrounding area. According to the news, the dead fish started washing up around noon of June 3rd, and as of early afternoon on June 4th, the situation still remained pretty much out of control.

The amount of dead sardines that has washed up is thought to total several dozen metrics tons, so you can imagine how bad the smell of rotting fish must be. We’ve seen the pictures uploaded onto Twitter, and the port looks completely filled with fish – it almost looks like a carpet of sardines. It doesn’t seem likely that any fishing boats will be setting sail from this port soon.

There are also, of course, the usual posts and comments on the internet on how this could be an omen, a sign of a coming great natural disaster. When we inquired with a local inn, we were told that the port was scheduled to be closed from June 1st to 5th, but given the emergency, local fishermen are currently out in full force trying to resolve the situation. Already more than 2 full days into the bizarre occurrence, the smell has to be almost unbearable, but the people of Ohara still have no idea when they will be able to get rid of all the sardines. We sincerely hope they will be able to solve the problem quickly. –Rocket News 24

Moody’s cut the credit ratings of several German banks

Moody’s Investors Service cut the credit ratings of several German banks on Wednesday, citing increased risk of further shocks emanating from the euro zone debt crisis and their limited loss-absorption capacity.

“As a result, the long-term debt and deposit ratings for six groups and one German subsidiary of a foreign group have declined by one notch, while the ratings for one group were confirmed,” it said.

The banks included the New York and Paris branches of Commerzbank, Germany’s second-largest lender. Commerzbank U.S. Finance Inc., Dresdner Bank AG, its New York branch as well as Dresdner Finance B.V. also had their ratings cut.

Moody’s also said that further to these actions, it had assigned stable outlooks to the ratings of most German banks.

Moody’s said the ongoing rating review for Deutsche Bank AG and its subsidiaries will be concluded together with the reviews for other global firms with large capital markets operations.

It noted that several factors have caused the ratings of many German banks to decline by less than other European banks, including below-average unemployment, low household and corporate debt levels and the general resilience of the German economy.

The Globe and Mail

The UN Wants Complete Control Over The Internet

One of the fastest ways to ruin the Internet would be to put theUnited Nations in charge of it. Unfortunately, that is exactly what the United Nations wants. The United Nations is now pushing very hard for complete control over the Internet. A proposal that has the support of China, Russia, India, Brazil, Saudi Arabia and Iran would give control of the Internet to the UN’s International Telecommunication Union. This is perhaps the greatest threat to the free and open Internet that we have seen yet. At a UN conference in Dubai this upcoming December, representatives from 193 nations will debate this proposal. The United States and many European nations are firmly against this proposal, but it is unclear whether they have the votes to stop it. Unlike the Security Council, there are no vetoes when it comes to ITU proceedings. So the United States may not be able to stop governance of the Internet from being handed over to the United Nations. The United States could opt out of any new treaty, but that would result in a “balkanized” Internet. If the UN gains control over the Internet, you can expect a whole new era of censorship, taxes, and surveillance.

It would be absolutely catastrophic for the free flow of commerce and information around the globe. Unfortunately, many repressive regimes are very dissatisfied with how the Internet is currently working and they desperately want to be able to use the power of the UN to tax, regulate and censor the Internet. Needless to say, that would be a disaster. International control over the Internet would be a complete and total nightmare and it must be resisted.

Top Internet experts are sounding the alarm bells about this proposal as well. The following comes from a recent CNET article….

Vint Cerf, Google’s chief Internet evangelist, co-creator of the TCP/IP protocol, and former chairman of ICANN, said the ITU meeting could lead to “top-down control dictated by governments” that could impact free expression, security, and other important issues.

“The open Internet has never been at a higher risk than it is now,” Cerf said.

Sadly, the United States cannot block this from happening. As an article by Robert M. McDowell explained, all it is going to take for this proposal to be accepted is for a simple majority of the 193 UN members states to agree to it….

Regulation proponents only need to secure a simple majority of the 193 member states to codify their radical and counterproductive agenda. Unlike the U.N. Security Council, no country can wield a veto in ITU proceedings.

Once the ITU gains control, the United States and other nations could attempt to “opt out”, but that would create a “balkanized” Internet that would be much different than what we have today.

The powers that would be given to the ITU under the current proposal would be extraordinary. A recent article in the Wall Street Journal summarized some of the powers that the ITU would be granted….

• Subject cyber security and data privacy to international control;

• Allow foreign phone companies to charge fees for “international” Internet traffic, perhaps even on a “per-click” basis for certain Web destinations, with the goal of generating revenue for state-owned phone companies and government treasuries;

• Impose unprecedented economic regulations such as mandates for rates, terms and conditions for currently unregulated traffic-swapping agreements known as “peering.”

• Establish for the first time ITU dominion over important functions of multi-stakeholder Internet governance entities such as the Internet Corporation for Assigned Names and Numbers, the nonprofit entity that coordinates the .com and .org Web addresses of the world;

• Subsume under intergovernmental control many functions of the Internet Engineering Task Force, the Internet Society and other multi-stakeholder groups that establish the engineering and technical standards that allow the Internet to work

Some members of the U.S. Congress are deeply concerned that ITU control over the Internet would also open the door for oppressive global taxation of Internet companies….

“Google, iTunes, Facebook, and Netflix are mentioned most often as prime sources of funding,” McDowell said. Added Rep. Anna Eshoo, a California Democrat whose district includes Facebook’s headquarters, many countries “don’t share our view of the Internet and how it operates.”

A lot of smaller nations are supporting this proposal because of the money it could mean for them.

Many developing nations see international control over the Internet as a potential revenue bonanza as a recent CNN article explained….

Also pushing for international controls are developing countries hungry not only for political control, but also for new sources of revenue. (Allowing foreign phone companies to collect fees on international traffic is one proposal under discussion.) Grenell, who saw the regulatory effort spring up from the beginning a decade ago, notes that developing countries at the U.N. “get excited about taking up global issues that will give them more control and influence over commerce, that require businesses to seek their input and approval.”

But taxation would not be the greatest threat to the free and open Internet.

Censorship would potentially be an even greater threat.

Do you really want China, Russia, Saudi Arabia and Iran to be involved in setting standards for what is “acceptable” communication over the Internet?

In China, Internet censorship has become an art form.

For example, check out the new regulations that were recently imposed on Chinese “microbloggers”….

A five-strikes-and-out rule will see anyone posting five tweets on “sensitive” subjects have their account on Sina’s Weibo suspended for 48 hours.

Anyone whose posts continue to irk the censors could then have their accounts closed permanently.

The code of conduct, which bans the spread of “state secrets”, “false information”, and anything that harms “national unity” went into force on Monday.

Would you like that kind of regulation to come to Facebook and Twitter?

Don’t think that it can’t happen. The following excerpt from a recent CNET article should be sobering for all of us….

In 2008, CNET was the first to report that the ITU was quietly drafting technical standards, proposed by the Chinese government, to define methods of tracing the original source of Internet communications and potentially curbing the ability of users to remain anonymous. A leaked document showed the trace-back mechanism was designed to be used by a government that “tries to identify the source of the negative articles” published by an anonymous author.

Do you want China to be able to identify and locate you every time you say something bad about them on the Internet?

As I have written about previously, governments all over the world already use the Internet to spy on all of us.

How much worse would Internet surveillance become if the United Nations was in charge?

If the United Nations gets control over the Internet, that will be a giant step toward the United Nations becoming a true world government. The Internet has become an essential part of our daily lives, and allowing the UN to govern it would give them an extraordinary amount of power over all of us.

Pakalert Press

Top Internet experts are sounding the alarm bells about this proposal as well. The following comes from a recent CNET article….

Vint Cerf, Google’s chief Internet evangelist, co-creator of the TCP/IP protocol, and former chairman of ICANN, said the ITU meeting could lead to “top-down control dictated by governments” that could impact free expression, security, and other important issues.

“The open Internet has never been at a higher risk than it is now,” Cerf said.

Sadly, the United States cannot block this from happening. As an article by Robert M. McDowell explained, all it is going to take for this proposal to be accepted is for a simple majority of the 193 UN members states to agree to it….

Regulation proponents only need to secure a simple majority of the 193 member states to codify their radical and counterproductive agenda. Unlike the U.N. Security Council, no country can wield a veto in ITU proceedings.

Once the ITU gains control, the United States and other nations could attempt to “opt out”, but that would create a “balkanized” Internet that would be much different than what we have today.

The powers that would be given to the ITU under the current proposal would be extraordinary. A recent article in the Wall Street Journal summarized some of the powers that the ITU would be granted….

• Subject cyber security and data privacy to international control;

• Allow foreign phone companies to charge fees for “international” Internet traffic, perhaps even on a “per-click” basis for certain Web destinations, with the goal of generating revenue for state-owned phone companies and government treasuries;

• Impose unprecedented economic regulations such as mandates for rates, terms and conditions for currently unregulated traffic-swapping agreements known as “peering.”

• Establish for the first time ITU dominion over important functions of multi-stakeholder Internet governance entities such as the Internet Corporation for Assigned Names and Numbers, the nonprofit entity that coordinates the .com and .org Web addresses of the world;

• Subsume under intergovernmental control many functions of the Internet Engineering Task Force, the Internet Society and other multi-stakeholder groups that establish the engineering and technical standards that allow the Internet to work

Some members of the U.S. Congress are deeply concerned that ITU control over the Internet would also open the door for oppressive global taxation of Internet companies….

“Google, iTunes, Facebook, and Netflix are mentioned most often as prime sources of funding,” McDowell said. Added Rep. Anna Eshoo, a California Democrat whose district includes Facebook’s headquarters, many countries “don’t share our view of the Internet and how it operates.”

A lot of smaller nations are supporting this proposal because of the money it could mean for them.

Many developing nations see international control over the Internet as a potential revenue bonanza as a recent CNN article explained….

Also pushing for international controls are developing countries hungry not only for political control, but also for new sources of revenue. (Allowing foreign phone companies to collect fees on international traffic is one proposal under discussion.) Grenell, who saw the regulatory effort spring up from the beginning a decade ago, notes that developing countries at the U.N. “get excited about taking up global issues that will give them more control and influence over commerce, that require businesses to seek their input and approval.”

But taxation would not be the greatest threat to the free and open Internet.

Censorship would potentially be an even greater threat.

Do you really want China, Russia, Saudi Arabia and Iran to be involved in setting standards for what is “acceptable” communication over the Internet?

In China, Internet censorship has become an art form.

For example, check out the new regulations that were recently imposed on Chinese “microbloggers”….

A five-strikes-and-out rule will see anyone posting five tweets on “sensitive” subjects have their account on Sina’s Weibo suspended for 48 hours.

Anyone whose posts continue to irk the censors could then have their accounts closed permanently.

The code of conduct, which bans the spread of “state secrets”, “false information”, and anything that harms “national unity” went into force on Monday.

Would you like that kind of regulation to come to Facebook and Twitter?

Don’t think that it can’t happen. The following excerpt from a recent CNET article should be sobering for all of us….

In 2008, CNET was the first to report that the ITU was quietly drafting technical standards, proposed by the Chinese government, to define methods of tracing the original source of Internet communications and potentially curbing the ability of users to remain anonymous. A leaked document showed the trace-back mechanism was designed to be used by a government that “tries to identify the source of the negative articles” published by an anonymous author.

Do you want China to be able to identify and locate you every time you say something bad about them on the Internet?

As I have written about previously, governments all over the world already use the Internet to spy on all of us.

How much worse would Internet surveillance become if the United Nations was in charge?

If the United Nations gets control over the Internet, that will be a giant step toward the United Nations becoming a true world government. The Internet has become an essential part of our daily lives, and allowing the UN to govern it would give them an extraordinary amount of power over all of us.

Pakalert Press

Leaders plotting EU superstate: 'Fiscal union' with the Germans in charge

European leaders are edging closer to a federal union in response to the financial crisis engulfing the Continent.

In crisis talks yesterday, Britain and the US joined forces to urge Germany to create a central Brussels body that could assume sovereignty over individual countries’ budgets and fiscal policies.

There is growing frustration in London and Washington at Germany’s reluctance to take steps towards a single economic government and put its vast resources behind the struggling countries in the eurozone.

Their fears were aired yesterday in a conference call between finance ministers from the G7 group of leading nations.

Four EU leaders have been asked to draft proposals for a deeper eurozone fiscal union, to be presented to an EU summit at the end of this month.

Senior Tory MPs are to press David Cameron to hold a referendum on Britain’s future in Europe if the moves go ahead.

They insist the Government must seek a mandate from voters to demand that key powers are repatriated from Brussels to Westminster in exchange for agreeing to treaty changes that would allow eurozone countries to pool sovereignty.

They fear a core eurozone, led by Germany, would be in a powerful position to push whatever policies it wanted affecting the rest of the 27-member EU.

The Prime Minister and Chancellor George Osborne have long argued that a single currency can only work if the eurozone creates an effective fiscal union.

They believe that for any single currency to work, richer areas must pay to support poorer ones.

Britain would stand outside any such arrangement, and Mr Cameron refused to sign a treaty taking more tentative steps towards a fiscal union last year.

But senior Conservatives say such a move would so fundamentally alter the balance of power and daily running of the EU that a referendum would have to be offered to determine whether British voters wanted to remain in Europe’s ‘slow lane’.

Up to ten chairmen of Commons select committees are understood to be preparing to call for a popular vote on Britain’s future place in the EU if a fiscal union goes ahead.

Referendum call: Tory MP Bernard Jenkin wants vote on Eu membership

Some believe Britain should leave the EU in such circumstances, while others argue that a demand for a looser relationship with Brussels would be given greater force if endorsed in a referendum.

Conservative MP Bernard Jenkin, chairman of the public administration select committee, said: ‘Clearly the European Union becoming a federation which expressly does not include the UK is a dramatic change in the terms of our relationship with our EU partners.

‘The Government needs to lay its demands on the table so British law and British taxpayers’ money are both protected by a sovereign UK Parliament.

‘Any new arrangements should be subject to a referendum.’

The Coalition has changed the law to ensure that no more powers can be passed from Westminster to Brussels without a referendum. But it is far from clear that one would be triggered if the eurozone countries decide to pool sovereignty.

German Chancellor Angela Merkel confirmed this week that measures to create a closer union for countries in the euro were being considered.

‘The world wants to know how we see the political union in complement to the currency union,’ she said.

‘That requires an answer in the foreseeable future and Germany will be a very constructive partner.’

Berlin does not expect to take final decisions on strengthening economic policy coordination until March 2013, with only a ‘roadmap’ being agreed at the Brussels summit this month.

Read more: http://www.dailymail.co.uk/news/article-2155082/Leaders-plotting-EU-superstate-Fiscal-union-looms--Germans-charge.html#ixzz1x1RJyCGL

G7: Fiscal union in Europe to help solve crisis

Do you see... Spain crisis = Fiscal Union

OTTAWA • After months of political rhetoric and fiscal sabre rattling, European leaders are being prodded by the world’s biggest countries to finally tackle the region’s debt problems before it is too late.

OTTAWA • After months of political rhetoric and fiscal sabre rattling, European leaders are being prodded by the world’s biggest countries to finally tackle the region’s debt problems before it is too late.

With Spain finally admitting it needs help to save its banking sector, finance chiefs of the Group of Seven industrialized nations on Tuesday pledged to help Europe look for ways to resolve its fiscal crisis.

That followed a conference call by G7 finance ministers and central bankers, which Finance Minister Jim Flaherty had announced the previous day to reporters in Toronto.

Bank of Canada governor Mark Carney was also on the Tuesday call.

For its part, Canada issued a statement after the call echoing those goals but also offering no firm action.

The U.S. Treasury, which chaired that meeting, said in a statement that the G7 discussed “progress towards a financial and fiscal union in Europe” and agreed to monitor developments closely. No other details on the talks were released.

The larger G20 group of countries will hold its scheduled meeting in Mexico on June 18 and 19.

“They (G7 chiefs) agreed to monitor developments closely ahead of the G20 summit in Los Cabos,” the Canadian statement said.

The Bank of Canada did not issue a statement on the talks.

But Prime Minister Stephen Harper, in an interview with CBC’s chief correspondent Peter Mansbridge in London, said, “I don’t want to sound too alarmist, but we are kind of running out of runway here.

Financial Post

With Spain finally admitting it needs help to save its banking sector, finance chiefs of the Group of Seven industrialized nations on Tuesday pledged to help Europe look for ways to resolve its fiscal crisis.

That followed a conference call by G7 finance ministers and central bankers, which Finance Minister Jim Flaherty had announced the previous day to reporters in Toronto.

Bank of Canada governor Mark Carney was also on the Tuesday call.

For its part, Canada issued a statement after the call echoing those goals but also offering no firm action.

The U.S. Treasury, which chaired that meeting, said in a statement that the G7 discussed “progress towards a financial and fiscal union in Europe” and agreed to monitor developments closely. No other details on the talks were released.

The larger G20 group of countries will hold its scheduled meeting in Mexico on June 18 and 19.

“They (G7 chiefs) agreed to monitor developments closely ahead of the G20 summit in Los Cabos,” the Canadian statement said.

The Bank of Canada did not issue a statement on the talks.

But Prime Minister Stephen Harper, in an interview with CBC’s chief correspondent Peter Mansbridge in London, said, “I don’t want to sound too alarmist, but we are kind of running out of runway here.

Financial Post

10 million properties are currently underwater

Recent housing data have been generally been encouraging. However,the large number of residential properties that are "underwater"—meaning the borrower owes more on the mortgage than the property is worth—casts a long shadow on the sustainability of the housing recovery. Goldman estimates that approximately 10 million properties are currently underwater. Although this number has not changed much during the past three years, there is much divergence across the nation: California, Michigan, and Arizona, for example, experienced significant improvement, while Georgia, Utah, and Missouri saw many more properties falling underwater during this period.

Even though the number of underwater properties stayed roughly unchanged at the national level over the past three years, different states experienced very different developments over this period of time. Exhibit 2 ranks states by the change in the percent of first-lien mortgages with negative equity from April 2009 to April 2012. Among the 31 states that had at least 0.5 million outstanding first-lien mortgages in April 2009, California, Michigan, and Arizona saw the largest improvement. For example, 42% of residential properties with mortgages in California were underwater in 2009, and that number came down to 29% in 2012. This trend likely resulted from both stabilizing house prices and the relatively fast speed at which foreclosed underwater properties are cleared out of the system. On the other end of the spectrum, Georgia, Utah, and Missouri experienced the largest deterioration in their negative equity problem. For example, 24% of residential properties with mortgages in Georgia were underwater in 2009, but that number increased to 42% in April 2012.This trend is largely caused by house prices falling more in these states than other states during the past three years.

What are the potential impacts of negative equity on the macro economy? Broadly speaking, negative equity affects the economy in two ways.

First, negative equity weighs on consumption. As shown in Dynan (2012, see full reference below), highly leveraged homeowners had larger declines in spending between 2007 and 2009 relative to other homeowners, and leverage appeared to weigh on consumption above and beyond what would have been predicted by housing wealth effects alone. The large number of underwater properties that we have estimated above suggests that many homeowners are still highly leveraged today. As a result, the deleveraging process they are going through is likely to drag down consumption and aggregate demand during the recovery.

Second, borrowers with negative equity are more likely to default on their mortgages. Both theoretical research, such as Campbell and Cocco (2011), and empirical research, such as Bhutta, Dokko, and Shan (2010), show that mortgage default rates increase significantly when borrowers become deeply underwater.

Given that there are 3 million first-lien mortgages that have LTVs of 125% or above as of April 2012, whether or not a large fraction of these mortgages will default in the near future has important implications for the housing market recovery.

Zero Hedge

Subscribe to:

Comments (Atom)