Thursday, July 5, 2012

Banks Submit Plans For Breaking Up In A Crisis

Nine of the largest U.S. banks have submitted plans offering roadmaps for how the government could break up and sell off their assets if they are in danger of failing.

The Federal Deposit Insurance Corp. released summaries of the "living wills" on Tuesday for Bank of America, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and UBS.

The plans were required under the 2010 financial overhaul, which gave regulators the power to seize and dismantle banks that threaten the broader financial system.

The government is trying to prevent another situation in which taxpayers are asked to provide bailouts to banks, which is what happened during the 2008 financial crisis. At the time, regulators didn't have rules in place to unwind banks considered "too big to fail."

More than 100 other banks are required to submit living wills by the end of next year. And all banks are required to update their living wills annually or sooner, if there's a material change in the company.

The lenders were asked to detail their assets and debts, how they're tied to other companies, and spell out how they would be wound down in a fast and orderly bankruptcy process.

Most of the information in the summaries had already been made public by the companies in regulatory filings. The more detailed plans provided to regulators were not made public because they included proprietary information.

So what details were included in the summaries?

JPMorgan Chase, the largest U.S. bank by assets, talked about maintaining a "fortress balance sheet" and a sufficient global liquidity reserve to deal with problems that might arise. At the end of last year, it estimated that reserve to be approximately $379 billion.

The bank also declared that its living will "provides for the resolution of the firm in a rapid and orderly way that, in the firm's view, would not pose systemic risk to the U.S. financial system."

Citigroup made a similar statement in its summary. It said its plan shows the company could be wound down in a way that addresses a potential systemic disruption in the U.S. or global financial markets without the use of taxpayer funds.

Goldman Sachs noted it believes all financial institutions, regardless of size, should be able to undergo a bankruptcy process without costing taxpayers.

Meanwhile, Morgan Stanley and Barclays each said in their summaries that their mock bankruptcy plans would mitigate serious financial jolt to the U.S.

The Federal Reserve and FDIC, however, have the last word. If they decide a bank's plan isn't adequate, the regulators can require the company to raise more capital, tamp down on growth, or even sell off units.

The banking industry has criticized the living wills as a pretext for allowing the government to split up big banks. On the other side, different critics say that the living wills don't go far enough, because they don't address the underlying issue that banks are too big.

Read more: http://www.businessinsider.com/not-too-big-to-fail-us-banks-submit-plans-for-breaking-up-in-a-crisis-2012-7#ixzz1zl0WfMmE

Lab grown human organs closer than ever

Science is one step closer to the creation of a functional, artificial human liver thanks to a team of American researchers and their work in the emerging field of "bioprinting."

Scientists have been experimenting with artificial cells for years, using high-tech 3D printing machines to build up layers of artificial cells into tissue structure.

Unfortunately, these synthetically engineered cells often die before the tissue is formed due to a lack of blood vessels, and in turn, a lack of nutrients and oxygen.

Researchers at the University of Pennsylvania and the Massachusetts Institute of Technology set out to solve this problem by building a synthetic vascular system using sugar.

"We created a network of places that we wish vessels to grow into, so they would become piping into the tissue, and we printed those in 3D out of sugar," said MIT professor and study co-researcher Sangeeta Bhatia to the BBC.

"We then surrounded the network with the cells that we would like to be fed by the blood vessels when the tissue is implanted - and once we have this structure of pipes-to-be and tissue, we dissolve away the sugar using water."

Interest in the potential of 3D printing machines to produce transplantable lab-grown organs has spread in recent years. This technology, if perfected, could help alleviate the world's donor organ shortage.

The study, which appears in the journal Natural Materials, details the process as quick, inexpensive and effective.

Human blood vessel cells injected throughout the artificial networks spontaneously generated new capillary sprouts, according to researchers. This is how blood vessels naturally grow in the human body.

And while their artificial blood vessel network was designed for a human liver, Prof. Bhatia said that these learnings could be applied toward any other bodily tissue.

"With this work, we've brought engineered liver tissues orders of magnitude closer to that goal, but at tens of millions of liver cells per gel we've still got a ways to go," she said.

"More work is needed to learn how to directly connect these types of vascular networks to natural blood vessels while at the same time investigating fundamental interactions between the liver cells and the patterned vasculature. It's an exciting future ahead."

What do you think of bioprinted organs? Should governments be investing more money into this type of innovation? If given the chance to receive an artificial organ that you needed, would you take it? Let us know your thoughts in the comment section below.

Your Community

Italy's deficit to double

Mario Monti, the Italian prime minister, told a joint press conference with Angela Merkel, the German chancellor, that Italy's deficit would rise to 2pc of GDP rather than the 1.3pc predicted, while the German finance ministry revised its forecast from 1pc to 0.5pc "thanks to the favourable overall economic development".

Referring to their clash at the Brussels summit, Mrs Merkel said she and Mr Monti were "willing to overcome our difficulties" and work together to end the three-year-old debt crisis. She said that "every day counts" in finding a resolution.

Francois Hollande, the French president, announced €7.2bn (£5.8bn) of tax rises in a bid to relieve France's "crushing" national debt. The government expects the French economy to grow by just 0.3pc this year, compared with previous estimates of 0.7pc. Despite the gloom, markets have risen in recent days in anticipation of an ECB rate cut.

Yesterday, the rally tailed-off as traders feared Mario Draghi, president of the ECB, would again resist the pressure to act. Germany's Dax was off 0.2pc, the French CAC slid 0.1pc and the FTSE 100 was almost flat.

Jim Reid, of Deutsche Bank, said: "The ECB is widely expected to ease its key rate by 25 basis points tomorrow but we can't help thinking that additional market-friendly action is required from Draghi to sustain this rally. The market is hoping that politicians have done enough to encourage the ECB to lend a hand. We suspect that they won't add additional support for now, which may lead to some disappointment."

The Telegraph

Destruction on massive scale in Syrian rebel stronghold of Homs

New photographs have been released showing destruction on an enormous scale in Homs as Syrian troops pounded several districts of the central city on Wednesday and clashed with rebels.

At least 19 people were killed in violence across the country, a watchdog said, as regime troops rained shells on the besieged, rebel-held district of Khaldiyeh, killing two civilians and wounding seven others.

Rebels and troops also clashed on Wednesday around the neighbourhood of Baba Amr — once a rebel held district which was reclaimed by the Syrian army in March after a month-long campaign of relentless shelling, Abu Bakr said.

National Post

Spain at 6.66%

Sounds Biblical to me....

Israel within range of missile tested by Iran

The Teheran regime said Iran’s Islamic Revolutionary Guard Corps fired

the Shihab-3 on July 3 in the central desert.

Officials said Shihab-3 reached a target 1,300 kilometers away as part of a multi-missile exercise (Israel is 1,000 kilometers away).

“In these exercises, we used missiles with a range of 2,000 kilometers, but the plan called for them to be fired only 1,300 kilometers,” IRGC Air Force commander Brig. Gen. Amir Ali Hajizadeh said.

The liquid-fuel Shihab has been deemed Iran’s first deployed IRBM. The missile comes in a solid-fuel variant called Sejil and has undergone enhancements in accuracy.

Officials said Shihab and other missiles were fired at a single target

in Iran’s Kavir desert as part of the Great Prophet-7 exercise. They said Shihab-1 and Shihab-2, with ranges of 300 and 500 kilometers, were also fired in what was termed a successful trial.

IRGC has also been preparing to demonstrate its new combat unmanned

aerial vehicles for Great Prophet-7, scheduled to end on July 4. Officials

said the UAVs were deployed as part of a combined missile and manned

aircraft operation against a mock Western power, particularly the United

States.

“The message of these Grand Prophet-7 maneuvers is to show the

determination, the will and the power of the Iranian people in defending

their national interests and core values,” IRGC deputy commander Gen.

Hussein Salami said. “It’s a reaction to those who are politically

discourteous to the Iranian people by saying ‘all options are on the

table.’ “

World Tribune

Gold Seen At USD 3,500, 6,000 And 10,000 Per Ounce

Gold Seen At USD 3,500, 6,000 and 10,000 Per Ounce

Today's AM fix was USD 1617.00, EUR 1285.37 and GBP 1032.90 per ounce.

Yesterday’s AM fix was USD 1608.50, EUR 1278.31 and GBP 1025.70 per ounce.

Gold rose by $24.40 in New York yesterday and closed up 1.5% at $1,622.80/oz. Silver surged to as high as $28.45 and ended with a gain of nearly 3%.

Gold has traded erratically overnight and this morning in Europe but is slightly lower than yesterday’s close in New York.

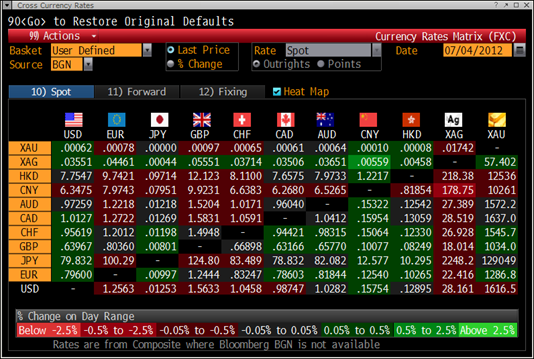

Cross Currency Table – (Bloomberg)

Further impetus to higher prices may come from the ECB who are expected to cut interest rates to a record low tomorrow – continuing ultra loose monetary policy which should further weaken the euro.

Negative interest rates continue to penalise pensioners and savers in European countries and this will lead to further diversification into gold.

Financial markets are already starting to wonder about the solidity of last week's summit measures to tackle the euro zone crisis and soon they may question whether even looser monetary policies will help prevent recessions and sovereign defaults.

With Independence Day today (Happy July 4th to all our American followers, clients and friends), the ECB decision tomorrow and NFP on Friday, trading should be quite today but as we know illiquid markets can lead to outsized market moves.

We tend to try and avoid predictions in GoldCore as the future is largely unknowable and there are so many variables that drive market action that it is nigh impossible to predict the future price of any asset class.

However, our opinion has long been that over the long term all fiat currencies will depreciate and devalue against the finite currency that is gold.

For this reason we have long held that gold would reach its inflation adjusted high of $2,400/oz and silver its inflation adjusted high at $140/oz and the equivalent in euros, pounds and other fiat currencies.

Gold at just over $1,600/oz today remains 33% below its record nominal high in 1980.

Silver at just over $28/oz today remains 80% below its record nominal high in 1980.

However, we have tended to focus on the important diversification, store of value and safe haven benefits of owning physical gold (and silver) bullion.

Overnight, some respected analysts of the gold market have suggested that gold is likely to or will reach much higher levels in the coming years – between $3,500/oz and $10,000/oz

(see commentary).

We see no reason to change these estimates and would concur with Amoss, Davies and Sinclair that there are strong grounds for believing that gold prices will rise much higher in the coming months and years.

Indeed, given the huge increase in credit growth and money supply internationally we believe that these estimates may in time be conservative.

NEWSWIRE

(Bloomberg) -- Turkey Exchange Says Gold Imports Were 23.9 Metric Tons in June

Turkey’s gold imports were 23.9 metric tons in June, the Istanbul Gold Exchange said on its website.

(Bloomberg) -- Kazakhstan Raises 2012 Gold-Purchase Target to 26 Tons

Kazakhstan, the largest oil producer in the former Soviet Union after Russia, raised its target for gold purchases this year to 26 metric tons as it encourages producers to refine their output domestically.

The country plans to boost domestic output to 70 metric tons a year by 2015 and wants to refine all of that at a new facility near the capital Astana, Industry and New Technologies Minister Aset Isekeshev told reporters in Astana today.

The central bank last month said it planned to buy 24.5 metric tons of gold this year.

(Bloomberg) -- Deadly Newmont Protests Lead Peru to Call State of Emergency

Peru declared a state of emergency in an area of the northern Andes after three people died in clashes between police and opponents of Newmont Mining Corp.’s $4.8 billion Minas Conga project.

The government imposed the measure in three provinces of the Cajamarca region where Newmont plans to build the copper and gold mine, Justice Minister Juan Jimenez told Lima-based Radio Programas yesterday. Authorities will investigate the cause of the deaths, Jimenez said.

The declaration comes a week after Newmont was cleared to resume work that was halted in November when its installations in the area were destroyed during six days of protests. President Ollanta Humala allowed the restart by the largest U.S. gold producer after it pledged to build reservoirs to ensure water supplies for farming in the region.

The clashes are a result of Humala’s government refusing to negotiate with those opposed to the project, regional president Gregorio Santos told Radio Programas yesterday. Newmont is committed to talks and to the region, according to an e-mail from the company’s local unit late yesterday.

Police fired tear gas and bullets at demonstrators after as many as 2,000 people planned to storm the town hall in Celendin, close to where the mine will be built, Radio Programas reported. Some protesters were armed and shot at the police, it said.

“We renew our commitment to Cajamarca and to our faith in dialog as a bridge to achieve understanding between everyone,” the statement from Newmont’s local unit said.

(Bloomberg) -- Platinum Users Seen by Moody’s Moving to Palladium on Prices

Platinum users will probably keep switching to palladium in the automobile, jewelry and financial sectors, Moody’s Investors Service said.

Palladium will probably trade between $600 to $900 an ounce over the next few years, Moody’s said in an e-mailed report today. “Platinum has traditionally sold at prices roughly four times that of palladium, but today platinum sells for close to twice the price of palladium,” says Arvinder Saluja, a Moody’s analyst and author of the report. “That spread is narrowing as new technology allows end-users to switch more easily to the lower-priced metal.”

Zero Hedge

Moscow Warns West of ‘Big War’ in Syria

Moscow lashed out on Thursday at the Western position on Syria, saying it could aggravate the situation to the point of war.

“Their [Western] position is most likely to exacerbate the situation, lead to further violence and ultimately a very big war,” Russian Foreign Minister Sergei Lavrov said.

The West has also distorted the Russian position on Syria by suggesting Moscow should offer Syrian President Bashar al-Assad asylum, he said.

“This is either an unscrupulous attempt to mislead serious people who shape foreign policy or simply a misunderstanding of what is going on,” Lavrov said.

He also warned that Russia will reject any UN Security Council peace enforcement resolution on Syria, since that would be “nothing but intervention.”

The minister also said representatives of the Syrian opposition will visit Moscow next week.

On Wednesday, Moscow urged Syrian opposition groups to unite to find a peaceful solution to the ongoing crisis.

The UN estimated in May that some 10,000 people have been killed in Syria since the beginning of a revolt against President Bashar al-Assad in March 2011. The Syrian Observatory for Human Rights, a London-based organization with a network of activists in Syria, revised the death toll to 16,500 on Monday. Of those, some 5,000 were government troops and army defectors, the group said. June had been the bloodiest month of the conflict so far, with around 100 deaths every day, it said.

The UN Security Council has so far failed to find a way to settle the conflict. Russia and China have refused to support any plans for outside interference in Syria.

RIA Novosti

Saudis are buying nuclear capable missiles from China

DEBKAfile’s military sources report that Saudi Arabia has set its feet on the path to a nuclear weapon capability and is negotiating in Beijng the purchase of Chinese nuclear-capable Dong-Fen 21 ((NATO-codenamed CSS-5) ballistic missile.

China, which has agreed to the transaction in principle, would also build a base of operations near Riyadh for the new Saudi purchases.

As we reported last year, Saudi Arabia has struck a deal with Pakistan for the availability on demand of a nuclear warhead from Islamabad’s arsenal for fitting onto a ballistic missile.

Riyadh owns a direct interest in the two most active Middle East issues: Iran and Syria.

Iran’s nuclear weapons program has been advancing for two decades regardless of countless attempts at restraint by every diplomatic tool under the sun and a rising scale of sanctions – to no avail.

Tehran marches on regardless of impediments. In Istanbul, Tuesday, July 3, the six powers and Iran failed the fourth attempt to reach an accommodation on Iran’s nuclear program.

The Syrian ruler Bashar Assad remains equally undeterred by international condemnation. Saturday, June 30, the US and Russia again failed to agree on a joint plan of action in Syria.

Saudi forces have been poised for action in Syria on the Jordanian and Iraqi borders since US Secretary of State Leon Panetta visited Riyadh in late June.

On July 1, they redoubled their military preparedness when the European Union clamped down an oil embargo on Iran. The Saudis, the US Fifth Fleet and the entire Gulf region are since braced for Iranian reprisals which could come in the form of closure by Tehran of the vital Straits of Hormuz to shipping or strikes against the Gulf emirates’ oil exporting facilities.

Tension shot up again when Iran’s Revolutionary Guards launched a three-day missile drill against simulated enemy bases in the region – expanding its threats to include US forces and bases in the region, Israel and Turkey.

More than one million in U.S. still without power five days after storm

(Reuters) - More than 1 million homes and businesses in a swath from Indiana to Virginia remained without power on Wednesday, five days after deadly storms tore through the region.

The outage meant no July 4 Independence Day holiday for thousands of utility workers who scrambled to restore lingering power outages.

Much of the damage to the power grid was blamed on last weekend's rare "derecho," a big, powerful and long-lasting wind storm that blew from the Midwest to the Atlantic Ocean.

Violent weekend storms and days of record heat have killed at least 23 people in the United States since Friday. Some died when trees fell on their homes and cars, and heat stroke killed others.

Energy provider Dominion Virginia Power said emergency crews were working around the clock to deal with 60,000 outages for its customers throughout Virginia as of noon Wednesday.

Service for virtually all customers in Northern Virginia and the Richmond metropolitan area who lost electric service because of the storms should be restored by Friday night, said Daisy Pridgen, a Dominion spokeswoman. In a few instances, work may continue into Saturday where there was extreme damage, she said.

More than 5,000 people from 18 states and Canada were working through the holiday, Rodney Blevins, a Dominion vice president, said in a statement. The company said it had restored power to about 90 percent of its 1 million customers who had lost electric service because of the weekend storms, the biggest non-hurricane outage in the company's history.

Much of the hardest-hit areas were to bake for another day in scorching heat, with the National Weather Service forecasting temperatures from 90 Fahrenheit (32 Celsius) to more than 100 F (37.7 C) from the Midwest to the Atlantic Coast.

In Washington, about 5,000 customers of local power company Pepco were still without power on Wednesday morning, and the city was distributing food to people who were unable to cook at home. Closer to 50,000 Pepco customers in suburban Maryland were still in the dark.

But the region still most affected, however, was West Virginia and the neighboring Blue Ridge Mountain section of Virginia, accounting for close to half of the lingering outage.

In West Virginia, 174,960 of Appalachian Power'shalf-million customers remain without electric service, the company said in a noon update on Wednesday.

Just over the state line in the mountains of western Virginia, 110,578 Appalachian clients remained blacked out, it said.

"Crews are continuing to find additional damage to our distribution and transmission facitilities," a statement on the company's website said. It said additional crews from outside the area will join restoration efforts as they become available.

More than 3,000 workers are dedicated to its effort in Virginia and West Virginia, the company said. Other utilities also pledged to keep crews working - some in 16-hour shifts - until the electricity was restored.

Virginia's Arlington County, across the Potomac River from Washington, still had 6,875 people without power as of 7 a.m, said John Crawford, deputy director of the county's office of emergency management.

Greek recession set to get far worse, minister warns....

ATHENS — IMF and EU auditors arrived in Athens on Tuesday to audit state finances and progress on bailout conditions, finance ministry sources said, as the new government warned that a bad recession had turned worse.

The audit by inspectors from the EU, European Central Bank and International Monetary Fund is expected to take weeks and comes as Greece’s new conservative government takes the full reins of power after winning elections on June 17.

Since the election, the coalition led by Prime Minister Antonis Samaras has has been stuck in limbo, hit by health problems and surprise resignations. The new finance minister Yannis Stournaras is expected to be sworn in on Thursday.

But the man already installed as deputy finance minister warned that the already battered Greek economy would contract by 6.7% in 2012 compared with an earlier forecast of 4.5%.

Greece suffered an economic contraction of 6.9% in 2011 and is now in its fifth year of recession.

“The economic situation is critical,” Christos Staikouras said citing alarming figures from recently released data by the state-run Centre of Planning and Economic Research (KEPE).

The disastrous data will certainly be part of the case put to the EU and IMF as auditors of the so-called troika review ministry books over the next few weeks. The heads of the troika mission arrive on Wednesday.

Financial Post

UK's borders 'will be closed' to refugees from Greece and other failing countries if eurozone collapses

David Cameron will close Britain's borders to EU citizens if the Euro collapses.

The Prime Minister said he is prepared to ban refugees from Greece and other failing economies from flooding the UK.

Mr Cameron has been told that he can make use of extraordinary legal powers to close the doors to European migrants who immigration officers cannot usually prevent coming to Britain.

The PM went further than any other minister before in revealing details of the government's contingency plans for the collapse of the single currency when he appeared at the Commons liaison committee.

He told the panel of senior MPs he would do "whatever it takes" to protect the UK and avoid a huge influx of migrants at a time of economic collapse and banking crisis.

Mr Cameron said: 'The legal position is that if there are extraordinary stresses and strains it is possible to take action to restrict migratory flows. But obviously we hope that does not happen.'

Pressed on whether he was ready to tighten border restrictions for troubled states such as Greece, he added: 'I would be prepared to do whatever it takes to keep our country safe, to keep our banking system strong, to keep our economy robust.

'At the end of the day as prime minister that is your personal and moral duty.

'I hope it wouldn't come to that but as I understand it the legal powers are available if there are particular stresses and strains.

'You have to plan, you have to have contingencies, you have to be ready for anything with so much uncertainty in our world.'

Read more: http://www.dailymail.co.uk/news/article-2168367/Eurozone-crisis-UKs-borders-closed-refugees-Greece-countries-eurozone-collapses.html#ixzz1zgPhCuql

Subscribe to:

Comments (Atom)