Was it really that long ago, that we used to brag that the next generation of Americans would be better off than their parents? The lexicon connected to this kind of thinking has completely disappeared from our national discussions about the economy. Despite President Obama’s claims that America is in full recovery, nothing could be further from the truth. The American economy is sick, very sick! The only issue left to decide is just how long the patient has to live?

The Bureau of Labor Statistics Proves Obama to be a Liar

According to Bureau of Labor Statistics, when President Obama took office in January 2009, there were 80,529,000 Americans who were not part of the workforce. There are 12,369,000 Americans who have left the workforce since Obama became President. Last month alone, the number of Americans who are not participating in the workforce jumped by 354,000 last month.

Since the crash of 2008, the size of the U.S. population has grown by 16.8 million people, but the number of full-time jobs has actually decreased by 140,000 people. Only a paltry 44% of American adults are employed for 30 or more hours each week which is the magic number for Obamacare in which employers are required to pay the health care costs for any employee who works 30 hours or more week.

The Obama administration is lying through its teeth as they claim that the nation’s unemployment rate fell to 5.5%. The 5.5% figure is at the top end of the range considered to represent full employment by most Federal Reserve policy makers. Happy days are here again as Obama is attempting to make it look like America is in full economic recovery. Actually, nothing could be further from the truth. Below is the “rosy picture” that President Obama would have you believe as you and yours cannot find a full-time job.

John Williams, the creator of Shadow Stats, tells a far different story when it comes to full employment. Williams claims that when the smoke and mirrors of government counting is stripped away, the actual unemployment rate is over 23%. Mr. Williams is scheduled to be a guest on The Common Sense Show on March 22, 2015 from 9-10pm Central. Below is Williams graphic representation of the the true unemployment rate.

More Proof That Full Time Jobs Are Disappearing from the American Landscape

The American population grew from February 2008 to February 2015 by a total of 16.8 million persons which added up to a 5.5% increase in total population. Disturbingly, not a single one of the 16.8 million persons, accounting for the population increase actually secured a full time job!

According to the Treasury Department, the Federal Reserve and the Bureau of Labor Statistics, debt creation has replaced job creation! Just how long can this party continue?

One of Obama’s favorite words is “sustainability”. Why isn’t the Washington Press Corps asking the President if these economic trends are sustainable beyond the 22 months that he has left in office?

Income Distribution for American Workers

Isn’t the American dream a wonderful thing? What American dream? As it has been said by many, the truth is that the American dream become the American nightmare.

Isn’t the American dream a wonderful thing? What American dream? As it has been said by many, the truth is that the American dream become the American nightmare.

Of all the disturbing trends being presented in this report, income distribution for most Americans is the most concerning. We are a nation mired in poverty. The hopelessness and desperation that accompanies poverty has engulfed approximately half of the country.

The year 2013 is the last year that we have income statistics available for American workers as the 2014 figures will not be out until mid-October.

The income numbers for American workers are beyond dismal. According to the Social Security Administration income statistics, almost one in four Americans made less than $10,000 per year in 2013. Four in ten Americans made under $20,000 per year.

- 15% of Americans made under $5,000 per year- 24% of Americans made under $10,000 per year- 39% of Americans made under $20,000 per year.- 52% of Americans made under $30,000 per year.- 63% of Americans made under $40,000 per year.- 72% of Americans made under $50,000 per year.

People from all sides of the economic argument agree that one out of six American face food vulnerability. Let me put it another way. One out of six Americans, in this economic pre-collapse period face starvation and the when the bubble in the American economy collapse (i.e. housing, auto and the Stock Market), we may see the food vulnerability numbers get flipped in which five out of six American face serious food shortages. Does it make send now why Obama is trying to take away ammunition from the people. Does it make more sense on why DHS has been arming to the teeth for the past two years?

Some people have called me an alarmist as I have advised people to take the bulk of their money out of the bank an invest their money into items which promote surviving an economic collapse. When the housing, auto and Stock Market crashes and the banks, who in one way or another, have underwritten these bad loans, one has to ask, how long will it be until the banks collapse as well?

In light of these statistics, does it make sense that the government is preparing for widespread bank failures? All nations belonging to the G20 have agreed to pass legislation that will fulfill a new investment program. This new program creates a whole new paradigm and set of rules whereby banks will no longer recognize your deposits as money. That means that when your bank fails, you will be last in line to receive FDIC reimbursement.

The Federal Reserve and the Bank of England Have Already Rehearsed the Theft of Your Bank Account

The theft of the people’s money has already been rehearsed by the powers that be in the banking industry. Regulators from the United States and the United Kingdom got together, late last year, in a war room to see how they will cope when the next big bank fails.

The theft of the people’s money has already been rehearsed by the powers that be in the banking industry. Regulators from the United States and the United Kingdom got together, late last year, in a war room to see how they will cope when the next big bank fails.

Treasury Secretary Jack Lew and the UK’s Chancellor of the Exchequer, George Osborne, on Monday (11/10), ran a joint exercise simulating how they would prop up a large bank (e.g. Bank of America) with operations in both countries that has landed itself in trouble. Also taking part in the “bank failure drill” was Federal Reserve Chair Janet Yellen and Bank of England Governor Mark Carney, and the heads of a large number of other regulators, in a meeting hosted by the U.S. Federal Deposit Insurance Corporation. The government is getting ready for widespread banking failures, are you?

Let’s take a brief look at those “bubbles” in the American economy that are on the verge of bursting.

Bubbles One and Two: Auto and Home Delinquencies

Home Delinquencies

Not only are Americans being foreclosed on in near record numbers, again, the numbers are very upsetting even more concerning that they were in 2008. Repeat foreclosures actually account for only 15% of total foreclosures during the 2008 crisis, but now repeat foreclosure actually make up a startling 51% of the total of actual foreclosures.

Most of the homes in this area should be condemned but the residents seem to find a way to drive new vehicles. The average income of this area is under $6,000 per year.

About 10 miles from where I live, there is a small hamlet of some of the worst ghetto conditions one would ever want to see. The filth, the failing foundations and the rotting roofs show signs of economic distress which rival any inner city ghetto of the worst kind. Yet, if you drive through this “development”, these people have brand new cars parked outside their collapsing rat pack houses. For a few years, I noticed the mismatched set of economics without realizing that I was witnessing an economic trend that is going to take down the economy in the same manner as did the housing collapse of 2008.

There is also a lot written about the parallels between today’s “subprime” auto lending market and the conditions which existed in the subprime housing market in 2008. The parallel between the auto subprime and the 2008 housing subprime is the same. Lenders did not learn their lesson as the lending to underqualified borrowers proliferates, leading to a large pool of securitizable loans.

The United States is in the midst of getting hit with a double whammy as we are experiencing both another housing collapse as well as a collapse of the auto industry. Meanwhile, the auto lenders who are making 84 month loans on new cars are dumping their short-term profits into the stock market, thus creating a third bubble and they are all going to collapse at the same time.

During his State of the Union Speech, President Obama falsely stated that the housing industry had recovered. Again, let’s go to Shadow Stats and look at new home starts following the collapse of 2008.

A cursory look at the data clearly shows that there never has been a housing recovery. Instead the housing crash simply leveled out and Obama is falsely calling this a full recovery.

Conclusion

When these three bubbles collapse at the same time, and the banks will surely follow, will it be time to say that our economy is in free-fall? When an economy is in free-fall, how far behind can martial law be when the social structure and the rule of law breakdown in favor of gathering resources needed for survival?

What is the government going to do with all these people who have no jobs, no future and will be increasingly in desperate search for food? Where will these people go when they cannot afford a roof over their head and food on their plate?

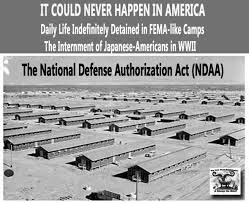

Is this the FINAL SOLUTION for the unemployed and the hungry? Is this what Henry Kissinger meant by his use of the term, “Useless Eaters”?

How do you think this is going to end? What can be done to soften the landing? Have you considered that World War III might be a viable solution because the government will not have to feed the dead? What do you think will be the FINAL SOLUTION?

Credit to Common Sense

No comments:

Post a Comment