Lawmakers have decided to suspend the debt ceiling again -- this time, at a level that's now about $512 billion higher than it was last fall.

On Tuesday, the Treasury Department reported that the nation's borrowing limit automatically reset to roughly $17.2 trillion, after the last suspension expired on Friday.

Here's why: Suspensions have become lawmakers' favorite way of "raising" the debt ceiling. They let Treasury borrow as needed to pay the bills and avert default. And when the suspension ends, the debt limit resets to the old cap plus whatever Treasury borrowed during the suspension period.

In other words, a suspension doesn't technically raise the debt ceiling, but that's the net effect.

The beauty for Congress is that lawmakers don't have to go on record as voting for a formal increase by a specific dollar amount.

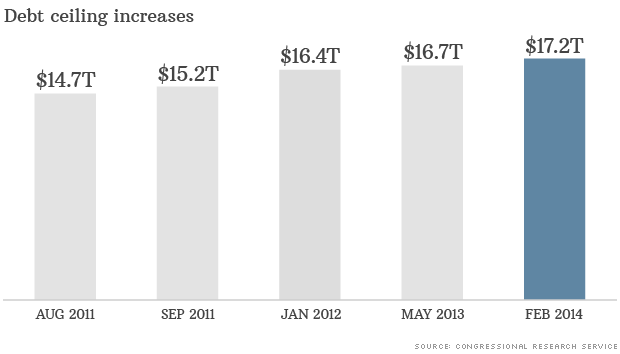

The reset to $17,211,558,177,668.77 marks the fifth effective increase in the debt ceiling since August 1, 2011, when it was $14.3 trillion.

The debt ceiling suspension approved this week by both the House and Senate will last through March 15, 2015. The Bipartisan Policy Center estimates that between now and then Treasury will have to borrow roughly $1 trillion.

Credit to CNN

No comments:

Post a Comment