Gold Seen At USD 3,500, 6,000 and 10,000 Per Ounce

Today's AM fix was USD 1617.00, EUR 1285.37 and GBP 1032.90 per ounce.

Yesterday’s AM fix was USD 1608.50, EUR 1278.31 and GBP 1025.70 per ounce.

Gold rose by $24.40 in New York yesterday and closed up 1.5% at $1,622.80/oz. Silver surged to as high as $28.45 and ended with a gain of nearly 3%.

Gold has traded erratically overnight and this morning in Europe but is slightly lower than yesterday’s close in New York.

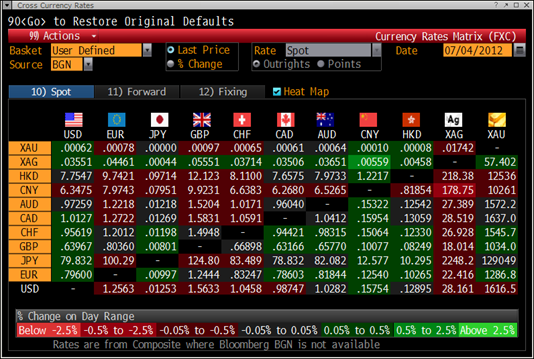

Cross Currency Table – (Bloomberg)

Further impetus to higher prices may come from the ECB who are expected to cut interest rates to a record low tomorrow – continuing ultra loose monetary policy which should further weaken the euro.

Negative interest rates continue to penalise pensioners and savers in European countries and this will lead to further diversification into gold.

Financial markets are already starting to wonder about the solidity of last week's summit measures to tackle the euro zone crisis and soon they may question whether even looser monetary policies will help prevent recessions and sovereign defaults.

With Independence Day today (Happy July 4th to all our American followers, clients and friends), the ECB decision tomorrow and NFP on Friday, trading should be quite today but as we know illiquid markets can lead to outsized market moves.

We tend to try and avoid predictions in GoldCore as the future is largely unknowable and there are so many variables that drive market action that it is nigh impossible to predict the future price of any asset class.

However, our opinion has long been that over the long term all fiat currencies will depreciate and devalue against the finite currency that is gold.

For this reason we have long held that gold would reach its inflation adjusted high of $2,400/oz and silver its inflation adjusted high at $140/oz and the equivalent in euros, pounds and other fiat currencies.

Gold at just over $1,600/oz today remains 33% below its record nominal high in 1980.

Silver at just over $28/oz today remains 80% below its record nominal high in 1980.

However, we have tended to focus on the important diversification, store of value and safe haven benefits of owning physical gold (and silver) bullion.

Overnight, some respected analysts of the gold market have suggested that gold is likely to or will reach much higher levels in the coming years – between $3,500/oz and $10,000/oz

(see commentary).

We see no reason to change these estimates and would concur with Amoss, Davies and Sinclair that there are strong grounds for believing that gold prices will rise much higher in the coming months and years.

Indeed, given the huge increase in credit growth and money supply internationally we believe that these estimates may in time be conservative.

NEWSWIRE

(Bloomberg) -- Turkey Exchange Says Gold Imports Were 23.9 Metric Tons in June

Turkey’s gold imports were 23.9 metric tons in June, the Istanbul Gold Exchange said on its website.

(Bloomberg) -- Kazakhstan Raises 2012 Gold-Purchase Target to 26 Tons

Kazakhstan, the largest oil producer in the former Soviet Union after Russia, raised its target for gold purchases this year to 26 metric tons as it encourages producers to refine their output domestically.

The country plans to boost domestic output to 70 metric tons a year by 2015 and wants to refine all of that at a new facility near the capital Astana, Industry and New Technologies Minister Aset Isekeshev told reporters in Astana today.

The central bank last month said it planned to buy 24.5 metric tons of gold this year.

(Bloomberg) -- Deadly Newmont Protests Lead Peru to Call State of Emergency

Peru declared a state of emergency in an area of the northern Andes after three people died in clashes between police and opponents of Newmont Mining Corp.’s $4.8 billion Minas Conga project.

The government imposed the measure in three provinces of the Cajamarca region where Newmont plans to build the copper and gold mine, Justice Minister Juan Jimenez told Lima-based Radio Programas yesterday. Authorities will investigate the cause of the deaths, Jimenez said.

The declaration comes a week after Newmont was cleared to resume work that was halted in November when its installations in the area were destroyed during six days of protests. President Ollanta Humala allowed the restart by the largest U.S. gold producer after it pledged to build reservoirs to ensure water supplies for farming in the region.

The clashes are a result of Humala’s government refusing to negotiate with those opposed to the project, regional president Gregorio Santos told Radio Programas yesterday. Newmont is committed to talks and to the region, according to an e-mail from the company’s local unit late yesterday.

Police fired tear gas and bullets at demonstrators after as many as 2,000 people planned to storm the town hall in Celendin, close to where the mine will be built, Radio Programas reported. Some protesters were armed and shot at the police, it said.

“We renew our commitment to Cajamarca and to our faith in dialog as a bridge to achieve understanding between everyone,” the statement from Newmont’s local unit said.

(Bloomberg) -- Platinum Users Seen by Moody’s Moving to Palladium on Prices

Platinum users will probably keep switching to palladium in the automobile, jewelry and financial sectors, Moody’s Investors Service said.

Palladium will probably trade between $600 to $900 an ounce over the next few years, Moody’s said in an e-mailed report today. “Platinum has traditionally sold at prices roughly four times that of palladium, but today platinum sells for close to twice the price of palladium,” says Arvinder Saluja, a Moody’s analyst and author of the report. “That spread is narrowing as new technology allows end-users to switch more easily to the lower-priced metal.”

Zero Hedge

No comments:

Post a Comment