Wednesday, September 20, 2017

Advice From The Trader Who Made $1 Billion In 1929..

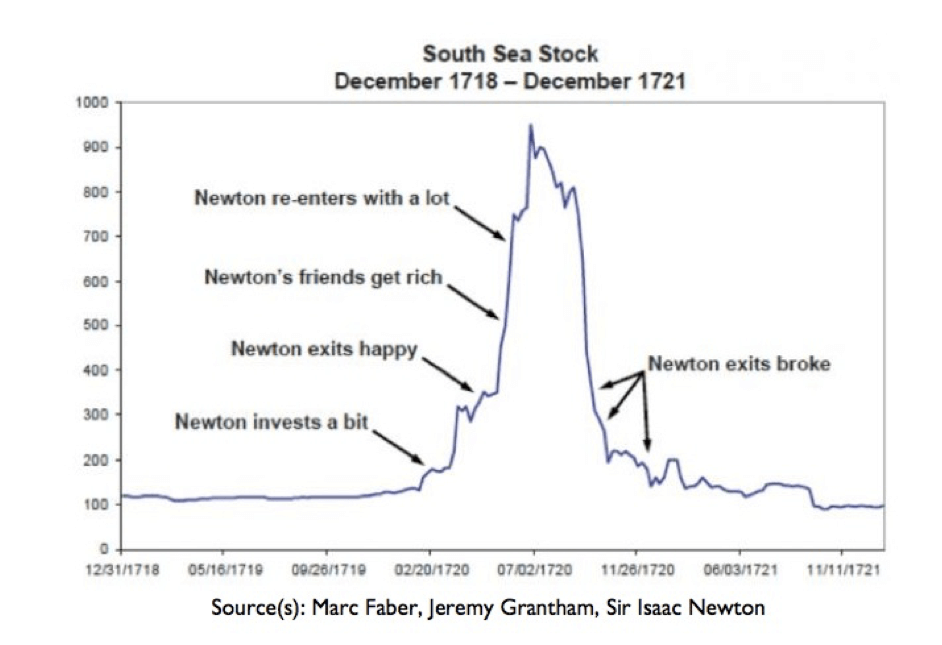

In the late spring of 1720, Sir Isaac Newton decided to sell his stocks.

Newton had been an investor in the South Sea Company, a famous enterprise which effectively commanded a trading monopoly with South America.

The investment had already made Newton a lot of money, he was up more than 100% in a very short time.

In fact, investors were clamoring to buy up the South Sea Company’s stock, and the share price kept climbing. And climbing.

Newton sensed that the market was getting overheated. It no longer made sense to him. So he sold.

There was only one problem: the share price of the South Sea Company kept climbing.

All of Newton’s friends were getting rich. So, against his better judgement, Newton went back in, repurchasing shares at more than three times the price of his original stake.

The market then collapsed, and he lost virtually all his life savings.

The experience is said to have given rise to his bemused response:

“I can calculate the movement of stars, but not the madness of men.”

* * *

It’s now been roughly ten years since the Global Financial Crisis began.

In the time-honoured manner of regulators, they waited until the battle was largely over, then waded onto the battlefield and shot the survivors.

The decade since has seen unprecedented monetary stimulus, i.e. central bankers have expanded their various money supplies by trillions upon trillions of dollars, giving rise to a massive bubble in asset price worldwide.

Stocks are at all-time highs. Bonds are at all-time highs. Property prices are at all-time highs. Many alternative assets like private equity and collectibles are at all-time highs.

Yet asset prices keep climbing.

Perhaps desperate to avoid the mistakes of Isaac Newton, Scotsman Hugh Hendry, founding partner of Eclectica Asset Management, has recently announced that he is closing his hedge fund.

Hendry is a famous critic of this monetary absurdity and consequent asset bubble.

“It wasn’t supposed to be like this.. markets are wrong,” Hendry told investors.

Of course, the market is under no obligation to be right. Ever.

Hendry’s view is accurate– nearly every objective metric shows that the market is incredibly overpriced.

Clint Eastwood’s infamous character Dirty Harry once remarked that a man needs to know his limitations. We think we know at least some of ours: we can’t time markets.

And the only thing we know with any certainty, as sure as night follows day, is that there are always corrections– both booms AND busts.

A decade’s worth of QE and ZIRP has fuelled a runaway train, and at some point there will be a correction.

Does it make sense to stand in front of the train? Or is it better to, as Isaac Newton did, leap aboard for some final thrills?

We prefer neither.

Instead we’re diversifying as pragmatically as we can, working diligently to find undervalued companies run by honest, talented managers.

It requires more hard work and patience than buying some overpriced index fund or whatever the popular investment du jour happens to be.

But nobody ever said this investing business was supposed to be easy.

Earlier this year my publishers invited me to write the foreword to their definitive edition of Reminiscences of a Stock Operator, a thinly disguised biography of the legendary trader Jesse Livermore.

Livermore was extraordinary. Born in 1877, Livermore ran away from home as a child and soon began trading stocks.

By the time he was 20, he had already amassed a fortune of $3 million, more than $75 million in today’s money.

Livermore sold short, i.e. bet that stock prices would fall, just prior to the 1907 crash, as well as the 1929 crash.

His bets were so lucrative that, going into the Great Depression, Livermore had a fortune of more than $100 million, or about $1.4 billion today.

But Livermore wasn’t just great at making money from overheated markets. He was also a master of losing money.

This book is widely and rightly regarded as an investment classic. It is also crammed with valuable observations about the practice of speculation and successful trading.

Among them, the importance of being patient and disciplined:

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made big money for me. It was always my sitting.”

Sitting. As in, doing nothing. As in… neither standing in front of the train, nor jumping on board.

Hedge fund managers like Hugh Hendry don’t have this option. They have to be invested. They have to report to their investors every quarter… and if they’re not making money, investors bail.

But as an individual, you are not accountable to anyone but yourself.

So you are free to sit… and patiently wait for the safe, compelling investments that will arise once market conditions return to sanity.

Do you have a Plan B?

Credit to Zero Hedge

Top Financial Expert Warns Stocks Need To Drop ‘Between 30 And 40 Percent’

Will there be a major stock market crash before the end of 2017? To many of us, it seems like we have been waiting for this ridiculous stock market bubble to burst for a very long time. The experts have been warning us over and over again that stocks cannot keep going up like this indefinitely, and yet this market has seemed absolutely determined to defy the laws of economics. But most people don’t remember that we went through a similar thing before the financial crisis of 2008 as well. I recently spoke to an investor that shorted the market three years ahead of that crash. In the end his long-term analysis was right on the money, but his timing was just a bit off, and the same thing will be true with many of the experts this time around.

Will there be a major stock market crash before the end of 2017? To many of us, it seems like we have been waiting for this ridiculous stock market bubble to burst for a very long time. The experts have been warning us over and over again that stocks cannot keep going up like this indefinitely, and yet this market has seemed absolutely determined to defy the laws of economics. But most people don’t remember that we went through a similar thing before the financial crisis of 2008 as well. I recently spoke to an investor that shorted the market three years ahead of that crash. In the end his long-term analysis was right on the money, but his timing was just a bit off, and the same thing will be true with many of the experts this time around.

On Monday, I was quite stunned to learn what Brad McMillan had just said about the market. He is considered to be one of the brightest minds in the financial world, and he told CNBC that stocks would need to fall “somewhere between 30 and 40 percent just to get to fair value”…

Brad McMillan — who counsels independent financial advisors representing $114 billion in assets under management — told CNBC on Monday that the stock market is way overvalued.“The market probably would have to drop somewhere between 30 and 40 percent to get to fair value, based on historical standards,” said McMillan, chief investment officer at Massachusetts-based Commonwealth Financial Network.

McMillan’s analysis is very similar to mine. For a long time I have been warning that valuations would need to decline by at least 40 or 50 percent just to get back to the long-term averages.

And stock valuations always return to the long-term averages eventually. Only this time the bubble has been artificially inflated so greatly that a return to the long-term averages will be absolutely catastrophic for our system.

Meanwhile, trouble signs for the real economy continue to erupt. As noted in the headline, it appears that Toys R Us is on the brink of bankruptcy…

Toys R Us has hired restructuring lawyers at Kirkland & Ellis to help address looming $400 million in debt due in 2018, CNBC had previously reported, noting that bankruptcy was one potential outcome.Kirkland declined to comment.Earlier Monday, Reorg Research, a news service focused on bankruptcy and distressed debt, reported Toys R Us could file for bankruptcy as soon as Monday.

This is yet another sign that 2017 is going to be the worst year for retail store closings in U.S. history. I don’t know how anyone can look at what is happening to the retail industry (or the auto industry for that matter) and argue that the U.S. economy is in good shape.

But most Americans seem to base their opinions on how the economy is doing by how well the stock market is performing, and thanks to relentless central bank intervention, stock prices have just kept going up and up and up.

In so many ways, what we are watching today is a replay of the dotcom bubble of the late 1990s, and this is something that McMillan also commented on during his discussion with CNBC…

Part of McMillan’s thesis is rooted in his belief that the lofty levels of the so-called FANG stocks — Facebook, Amazon, Netflix and Google-parent Alphabet — seem reminiscent of the dot-com bubble in the late 1990s.“I’ve been saying for about the past year, this year looks a lot like 1999 to me,” McMillan said on “Squawk Box.” “If you look at the underlying economics [and] if look at the stock market, the similarities are remarkable.”

I am amazed that so many big names continue to issue extremely ominous warnings about the financial markets, and yet most Americans seem completely unconcerned.

It is almost as if 2008 never happened. None of our long-term problems were fixed after that crisis, and the current bubble that we are facing is far larger than the bubble that burst back then.

I don’t know why more people can’t see these things. It has gotten to a point where “even Goldman Sachs is getting worried”…

The stock market bubble is now so massive that even Goldman Sachs is getting worried.Let’s be clear here: Wall Street does best and makes the most money when stocks are roaring higher. So in order for a major Wall Street firm like Goldman to start openly worrying about whether or not the markets are going to crash, there has to be truly MASSIVE trouble brewing.On that note, Goldman’s Bear Market indicator just hit levels that triggered JUST BEFORE THE LAST TWO MARKET CRASHES.

When things fall apart this time, it is going to be even worse than what we went through in 2008. In the aftermath, we are going to need people that understand that we need to fundamentally redesign how our system works, and that is something that I hope to help with. We cannot base our financial system on a pyramid of debt, and we cannot allow Wall Street to operate like a giant casino. Our entire economy has essentially become a colossal Ponzi scheme, and it is inevitable that it is going to come horribly crashing down at some point.

But for now, the blind continue to lead the blind, and most Americans are not going to wake up until we have gone over the edge.

Credit to Economic Collapse

Russian military exercises appear to be preparation for 'big war'

A NATO military leader said this past weekend that Russia is conducting military exercises near its borders with eastern European NATO countries that appear to be "serious preparation for a big war."

Gen. Petr Pavel, the head of NATO's Military Committee, NATO wants to re-establish military-to-military communications with Russia to avoid "unintended consequences of potential incidents during the exercise," reported CBS News.

The exercises Russia is conducting is part of a week-long program dubbed Zapad 2017 and is taking place along the borders of NATO nations Estonia, Latvia, Lithuania and Poland, as well as Finland, a non-NATO country.

The last time Zapad was conducted was in 2014, shortly before Russia invaded Ukraine, causing NATO to have some concern over this year's exercises, although they are carried out regularly every four years.

Russian President Vladimir Putin attended the military exercises Monday and Russian government news site TASS reported that 95 foreign monitors from 50 countries were also present at the event.

"They appear to be interested," Putin said.

This year's "Zapad," which means "west" in Russian, involved more than 12,000 Russian troops and a slew of fighter jets, missiles, helicopters and tanks displaying their abilities within Russian territory near European Union borders.

Credit to Upi.com

Japan deploys interceptor near DPRK missile flight path

TOKYO — Japan on Tuesday moved a mobile missile-defense system on the northern island of Hokkaido to a base near recent flyover routes of a missile fired by the Democratic People’s Republic of Korea.

Defense Minister Itsunori Onodera said a Patriot Advanced Capability-3 interceptor unit was deployed at the Hakodate base on southern Hokkaido "as a precaution" as part of government preparations for a possible emergency.

The relocation came after a DPRK missile was test-fired last week and flew over southern Hokkaido and landed in the Pacific off the island's east coast — the second flyover in less than a month.

The PAC-3 was brought from another base in Yakumo town on Hokkaido, about 80 kilometers northeast of Hakodate. The system has a range of about 20 kilometers.

Four more of Japan's 34 PAC-3 units, largely used to defend the capital region, were relocated to southwestern Japan recently after the DPRK warned of sending missiles toward the US territory of Guam.

Japan currently has a two-step missile defense system. First, Standard Missile-3 interceptors on Aegis destroyers in the Sea of Japan would attempt to shoot down missiles mid-flight. If that fails, surface-to-air PAC-3s would try to intercept them.

Credit to chinadailyasia.com

http://www.chinadailyasia.com/articles/254/59/47/1505806851356.html

Subscribe to:

Comments (Atom)